Market Verdict on Iron Ore:

• Bullish.

Macro:

• IEA said in its global electronic vehicle outlook that EV sales are expected to grow 35% on the year to 14 million units, accounted for 18% of the market value. The electronic power in automobile market estimated an equivalence to 5 million barrels of decrease on oil consumption per day by 2030.

Iron Ore Key Indicators:

• Platts62 $107.65, +3.30, MTD $117.30. The spread structure expanded as expected, because steel demand was stronger in Q2 compared with Q3. The market priced-in the steel mills curb. Thus, iron ore spread before September23 potentially become wider. Physical market successfully captured the reversal point of this round of rebound. Active trades happened from Tuesday afternoon, including almost all major mid-grade brands. In future, market focus expected to shift from discount brands including JMBF and MACF to premium brands including PBF, NHGF and BRBF, because the discount has narrowed for 3-4 months.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 26th)

• Futures 102,181,900 tons(Increase 1,421,100 tons)

• Options 116,449,100 tons(Increase 2,947,700 tons)

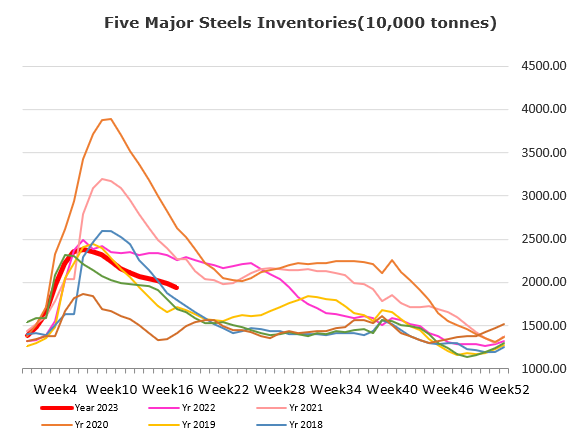

Steel Key Indicators:

• MySteel estimated 247 steel mills in China pig iron production down 540,000 tons to 73.68 million tons in April, up 18.64 million tons compared to same period over last year.

Coal Indicators:

• There were many offers for H2 PMV in Australia seaborne market arround $240- 243/mt, which created a theoretical roof area for the price. In addition, there was independent deal of half laycan PLV from Saraji traded at $253.5.