Market Verdict on Iron Ore:

• Neutral.

Macro:

• EU extended sanctions on imports of products from Russia, including steel and materials. Importers are required to prove that the materials they have used are not from Russia.

• The USD/CNH once reached new high at 7.24 since November 30th in 2022, because of the different interest rate strategies between U.S. and China.

Iron Ore Key Indicators:

• Platts62 $112.15, -0.25, MTD $112.68. Some Chinese sintered facilities suspension, following with macro change including U.S. interest hike and Chinese LPR decrease was smaller than expectation, iron ore market saw a correction after a two-week fast rebound. Seaborne market and port market saw light trade because of Chinese dragon boat festival.

• According to the Hebei Province Air Quality Forecast, from June 26th to July 1st, the air quality level in Tangshan was moderate to severe pollution. Mysteel indicated that many of Tangshan’s billet rolling mills stopped operation. Due to recent losses and high inventory of finished products, some manufacturers had already stopped production.

• Australian iron ore producer Grange Resources is facing industrial action at its 2.6mn t/yr Port Latta iron ore pellet and concentrate facility in Tasmania.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 26th)

• Futures 106,123,600 tons(Increase 2,860,500 tons)

• Options 115,351,600 tons(Increase 402,000 tons)

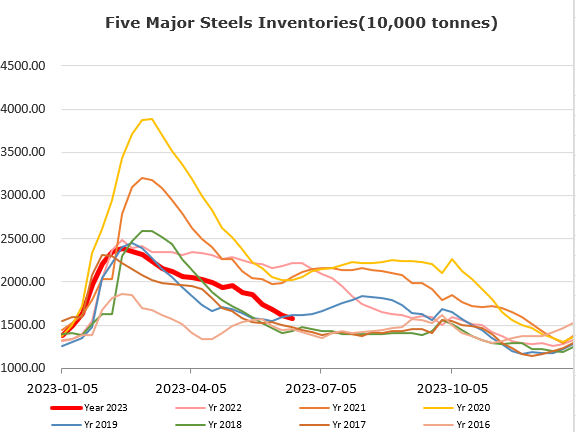

Steel Key Indicators:

• Turkey scrap maitianed stable mode as less bids and offers showing in the open market. The U.S. origin deal was booked at $380 by Marmara last Friday at $380 CFR for HMS ½ 80:20 scrap, which became the index level of the week.

Coal Indicators:

• Chinese met coal stocks at mills down 20,000mt to 7.25 million tons on the week, down 1.52 million tons on the year. Port stocks at 2.19 million tons, down 40,000mt on the week. The met coal inventories are decreasing fast in the current weeks in China.