Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Liu He had a video conference with U.S. Treasury Secretary Yellen. The conference revealed the expectation on tax exemption.

· China state council issued details on emission peak. At the year 2030, China non-fossil energy expecting to reach 25% of whole energy usage.

· U.S. October Markit Manufacturing PMI 59.2, created three months low. Est. 60.3. Last 60.7. U.S. Federal Reserve Chairman Powell indicated Federal potentially increase interest rate in the mid-2022 if inflation rate risk stay at high level by then.

Iron Ore Key Indicators:

· Platts62 $122.75, +3.00, MTD $122.57. Iron ore seaborne interests gradually moved from October and early November to late November and December. Seaborne and port trades both becoming significantly lighter compared to Q3. Both supply and demand were weak currently. Thus iron ore potentially consolidate in a range box. Moreover the restock for pellets and lump slight decrease after the materializing of winter production curb plan of most China cities.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 26th)

· Futures 75,813,400 tonnes(Increase 2,251,600 tonnes)

· Options 85,524,500 tonnes(Increase 180,500tonnes)

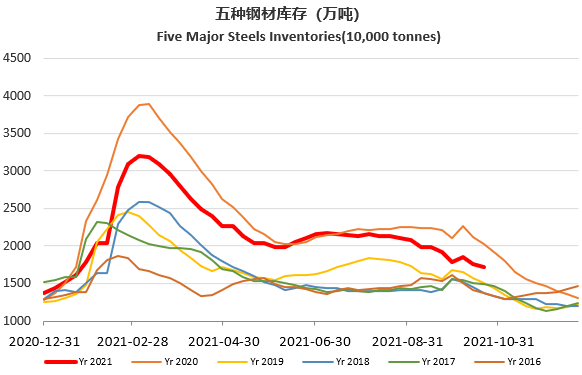

Steel Key Indicators

· Ganggu Construction Steel Inventory: production 4.59 million tonnes, down 6,500 tonnes w-o-w. Mills inventory 4.49 million tonnes, up 134,400 tonnes w-o-w. Circulation inventory 8.06 million tonnes, down 341,200 tonnes w-o-w.

Coal Indicators

· China NDRC quoted an article said the China coal market will step into a price decreasing tunnel. However the natural decrease on coal needs 2-3 months according to fundamental factors.

· China and Mongolia held conference to keep 600-800 trucks clearing ports, targeting to clear 8.94 million coal inventories by the February of the year 2022 at one major coal stockpile area in Mongolia.