Market Verdict on Iron Ore:

• Neutral.

Macro:

• China NBS statistic indicated that Jan- Mar 2023 industrial profit amount above designated scale reached 151.67 million yuan, down 21.4% on the year.

• U.S. Q1 GDP growth rate at 1.1%, lower than expected 2.0%.

Iron Ore Key Indicators:

• Platts62 $106.05, -1.60, MTD $116.68. The spread structure expanded as expected, because steel demand was stronger in Q2 compared with Q3. The market priced-in the steel mills curb. Thus, iron ore spread before September23 potentially become wider. Physical market successfully captured the reversal point of this round of rebound. Active trades happened from Tuesday afternoon, including almost all major mid-grade brands. In future, market focus expected to shift from discount brands including JMBF and MACF to premium brands including PBF, NHGF and BRBF, because the discount has narrowed for 3-4 months.

• Vale executive indicated that the production guidance for 2023 maintained at 310 – 320 million tons, although Q1 production decreased because of the weather and incidents.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 27th)

• Futures 100,864,400 tons(Decrease 1,317,500 tons)

• Options 118,182,900 tons(Increase 1,733,800 tons)

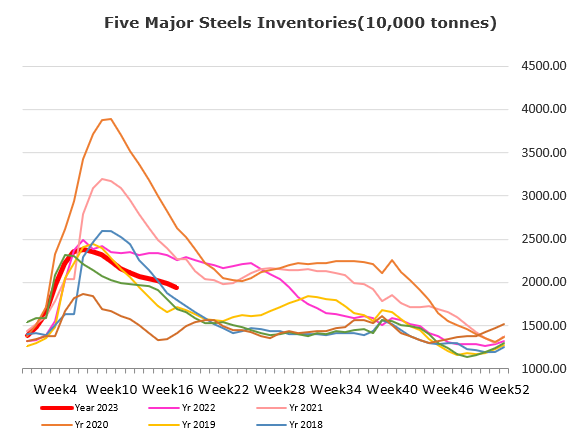

Steel Key Indicators:

• MySteel estimated EAFs average cost 3913 yuan/ton, down 218 yuan/ton on the week, average loss at 80 yuan/ton, up 6 yuan on the week.

Coal Indicators:

• There were many offers for H2 PMV in Australia seaborne market arround $240- 243/mt.