Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• U.S. Federal increased 75 basis points in last FOMC to 2.25-2.5%, as expected.

• G7 revealed to set up a price-ceiling for Russian oil effective from December 5th.

Iron Ore Key Indicators

• Platts62 $111.05, -0.65, MTD $106.24. The term contract discounts for BHP’s August MACF widened to 4.8% from 4%, JMBF to 9.3% from 9.25%. Steel margins improved after the decrease in coke and iron ore prices during past few weeks. Construction steel daily trades increased from last week significantly. Multiple buying interests on MOC were heard for PBF, NHGF, after bids vanished for almost four weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 27th)

• Futures 116,943,800tons(Increase 771,800 tons)

• Options 98,417,500 tons(Increase 640,000 tons)

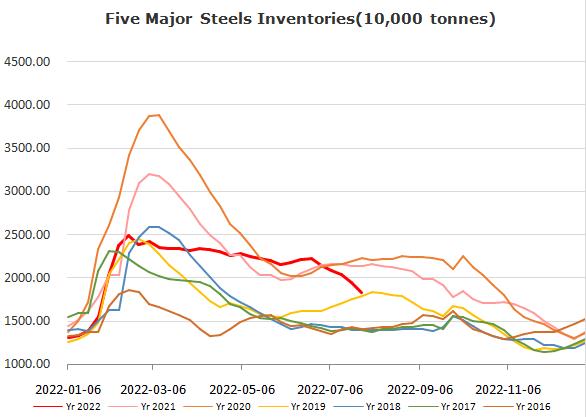

Steel Key Indicators

• World Steel Association reported crude steel production 158.1 million tons, down 5.9% on the year.

Coal Indicators

• Some Chinese steel mills started to decrease bids on coke by 200 yuan/ton, five rounds total decrease by 1000 yuan/ton.