Market Verdict on Iron Ore:

• Neutral.

Macro:

• The strong typhoon Doksuri landed in eastern China, which potentially cause some downstream work sites and steel mills’ operation halt.

• China NBS: H1 industrial value added amount 3.38 trillion yuan, down 16.8% on the year, improved by 2% from Jan – May.

Iron Ore Key Indicators:

• Platts62 $113.10, -3.35, MTD $112.75. The latest production curb in some of southern China provinces raised concerns on pig iron demand. There was rumor saying the restriction would not impact EAFs, while the blast furnace and iron ore demand need to cut in H2 2023.

• MySteel estimated 45 China ports iron ore inventories at 12.452 million tons, down 886,000 tons on the week. Daily evacuation at 3.14 million tons, down 12,000 tons.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 27th)

• Futures 112,126,000 tons(Increase 244,400 tons)

• Options 109,482,800 tons(Increase 763,500 tons)

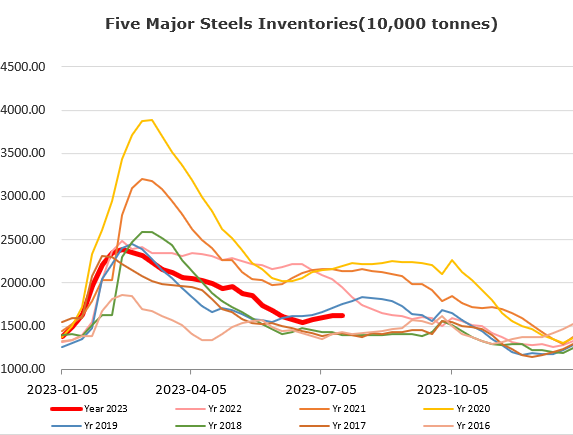

Steel Key Indicators:

• MySteel estimated 247 steel mills operation rate at 82.41%, down 1.46% on the week, up 10.53% on the year. Blast utilisation rate at 89.82%, down 1.33% on the week, up 10.53% on the year.

Coal Indicators:

• China cokery plants hiked physical coke price by 100-110 yuan/ton, three rounds of increased totaled 300-330 yuan/ton.