Market Verdict on Iron Ore:

Neutral to bullish.

Macro

China NBS: Jan- Aug industrial profit above designated scale amount reached 5.5 trillion yuan, down 2.1% on the year.

Nord Stream AG found that three pipelines were damaged, which is unprecedented. The Company was not able to estimate when the natural gas transmission infrastructure will be restored.

Iron Ore Key Indicators:

Platts62 $97.60, +1.55, MTD $98.71. PBF and NMHG regained popularity, with significantly improved volume in late half of August, however the premium disappeared as the strong U.S. dollar versus Chinese yuan diminish the buying power of import cargoes. CSN sold multiple laycans of IOC6 at October Index with a discount of $4.6- 4.75 during last two weeks, currently market saw improving interest in high silica products.

Benedikt Sobotka, CEO of diversified minerEurasian Resources Group (ERG), said that iron ore pellet spot premiums of $25-$45/mt over the 62% gradecould be considered “reasonable” aligned to the fact that high energy costs and low emitting materials in the next decade.

Some steel mills received notice to restrict production according to different environment scores. A scored steel mills are required to cut sintering by 30%. Below A scored mills are required to cut 50%. However most of mills indicated that they have at least 7-8 days of sintered ores inventories.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 27th)

Futures 107,825,700 tons(Increase 430,100 tons)

Options 94,206,000 tons(Increase 1,094,000 tons)

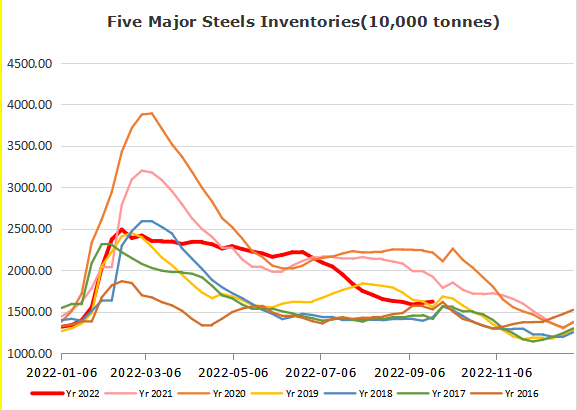

Steel Key Indicators

MySteel estimated 40 EAFs average rebar cost 4190 yuan/ton, down 54 yuan/ton. Average loss 179 yuan/ton.

Coal Indicators

Australia FOB coking coal remained quiet around $258, the market was waiting for a clear direction before Australia entered wet season as well as the uncertainty caused by industrial action.