Market Verdict on Iron Ore:

• Neutral.

Macro

• China National Bureau of Statistics: China will focuson increasing competitive advantage over the global environment, strengthening economy, decreasing tax and maintaining prices.

• China National Bureau of Statistics: China above designated size enterprises realized industry profits at 8.7 trillion yuan, up 34.3% from the year 2020. Two year average grow rate at 18.2%.

Iron Ore Key Indicators:

• Platts 62%: $138.75 (+0.65) MTD $129.72. Although iron ore futures rebound massively over the week, both portside and seaborne trades remain quiet. Current index only reflect some tiny trades. Discounted medium grade iron ore concentrates continue to attract buying interest and squeeze PBF out of the market. Portside iron ore current became more cost-effective compared with seaborne. In addition, buyers don’t need to take risk on laycan delay or index change.

• MySteel 45 ports iron ore inventories at 153.099 million tonnes, down 1.26 million tonnes w-o-w. Australia iron ore 70.25 million tonnes. Brazil iron ore 53.47 million tonnes. 174 ships at ports, up 4.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 27th)

• Futures 93,224,800 tonnes(Increase 1,314,800 tonnes)

• Options 52,272,300 tonnes(Increase 1,109,500 tonnes)

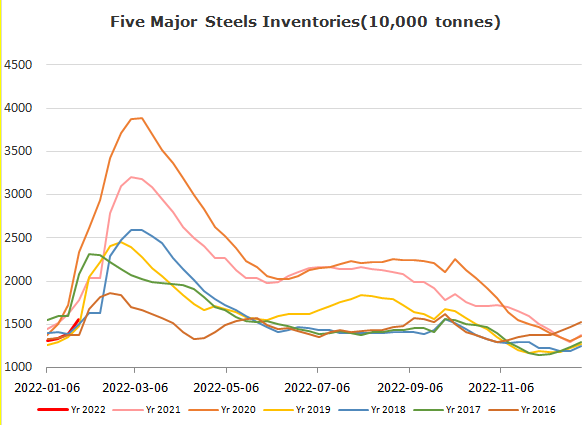

Steel Key Indicators

• Mysteel researched 247 steel mills pig iron daily production at 2.19 million tones, up 11,500 tonnes w-o-w.

Coal Indicators

• Mongolia closed major coal export ports from Jan 29th and entering Lunar New Year holiday.

• China National Development of Reform Commission arranged the coal supply plan across the New Year holiday next week, and maintain the price stabilization.