Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Liu He had a video conference with U.S. Treasury Secretary Yellen. The conference revealed the expectation on tax exemption.

· China state council issued details on emission peak. At the year 2030, China non-fossil energy expecting to reach 25% of whole energy usage.

· U.S. October Markit Manufacturing PMI 59.2, created three months low. Est. 60.3. Last 60.7. U.S. Federal Reserve Chairman Powell indicated Federal potentially increase interest rate in the mid-2022 if inflation rate risk stay at high level by then.

Iron Ore Key Indicators:

· Platts62 $119.65, -3.10, MTD $122.41. According to CISA, iron ore Q4 average monthly import 85.67 million tonnes, last Q4 at 97.5 million. The import in 2021 expected down 6.9% at 1.09 billion tonnes y-o-y. Iron ore was in a turmoil of winter production curb. Thus Sep-Dec21 contracts in SGX and DCE Jan22 were weakly consolidated. Because of this winter production curb, the demand shifted to current months instead of year end contract, Nov-Dec 21 maintained higher arround $1.7 compared with spreads across Dec21 – Mar22. The outright contracts expected to become neutral currently since some China domestic mines expected to run at low utilisation rate during winter. Thus encouraged some demands of seaborne sources.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 27th)

· Futures 76,435,800 tonnes(Increase 622,400 tonnes)

· Options 86,454,500 tonnes(Increase 930,000 tonnes)

Steel Key Indicators

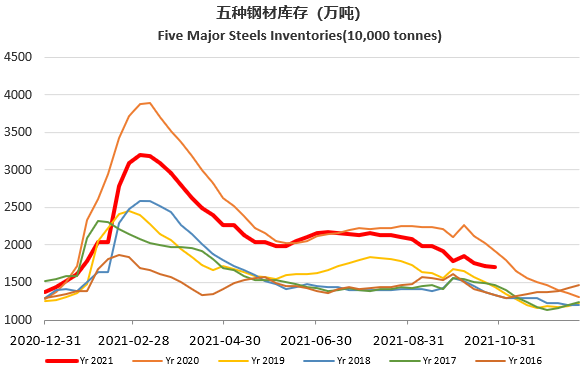

· MySteel Rebar Inventory: Rebar production 2.9056 million tonnes, up 6.32% w-o-w. Mills inventory 7.14 million tonnes, up 14.61% w-o-w. Circulation inventory 11.71 million tonnes, up 17.46% w-o-w.

· Tangshan billet cost after tax at 4883 yuan/tonne, up 10 yuan/tonne w-o-w. Steel profit at 17 yuan/tonne, down 330 yuan/tonne w-o-w.

Coal Indicators

· China Jineng Holding Group, Shanxi Coking Coal Group, Lu’An Chemical group, Huayang New Material Technology Group guaranteed the 5500 kcal thermal coal pithead price roof at 1200 yuan/tonne during the winter of 2021 and spring of 2022.