Market Verdict on Iron Ore:

• Neutral.

Macro:

• German Prime Minister Olaf Scholtz insisted on the ban on Russian oil at the end of this year. The German government plans to levy a profit tax of up to 33% on traditional fossil energy companies such as natural gas, oil and coal.

• China NBS: China industrial valued added amount above designated scale reached 6.98 trillion yuan from January to October, down 3% on the year. The ferrous metallurgical industries down 92.7% on the year.

• China PBOC cut RRR by 0.25% to 7.8%, effective from December 5th, equal to release 500 billion yuan long-run liquidity.

Iron Ore Key Indicators:

• Platts62 $95.20, +1.00, MTD $91.42. The continuous sentiment on the Chinese local bank support the housing companies to delivery houses, plus the new decrease on the RRR, supported the last week growth of iron ore. Some mills started to prepare the first load of Chinese New Year stock. However, the early purchase and macro sentiment look exaggerated the market sentiment, iron ore hasn’t saw a fundamental change, including still decreasing pig iron production and a reluctant buying from steel mills to maintain seaborne iron ores inventories at a-year-low. The month spread in SGX expected to maintain resilient supported by higher base on outright as well as improved market sentiment on current months.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 25th)

• Futures 122,494,800 tons(Increase 1,538,200 tons)

• Options 98,326,600 tons(Increase 1,492,500 tons)

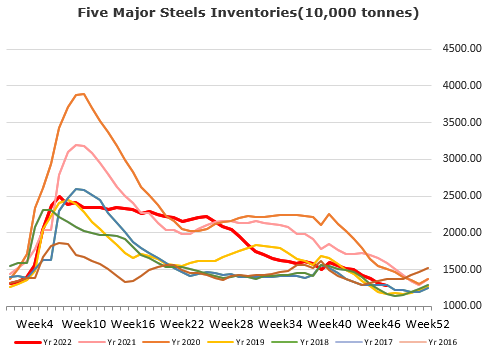

Steel Key Indicators:

• Surveys indicated that major EAFs winter stock was significantly smaller compared to 2020 and 2021, because of a-year loss as well as high scrap collecting price.

Coal Indicators:

• Australia FOB market consolidated from $245-247.Tradable levels were heard in the $240-250/mt FOB Australia for December loading. The index was linked to massive trade at $246.5 for Goonyella PMV at current days.