Verdict:

• Short-run Neutral to Bearish.

Macro:

• The PBOC released China’s monetary policy implementation report for the third quarter. The report pointed out that China’s economy will continue to return to normal, and expected that the annual growth target of about 5% can be successfully achieved.

• Saudi Arabia seeks OPEC+ to cut output quotas, but some members oppose it. The OPEC+ members will held JMCC conference in November 30th with final decisions.

Iron Ore Key Indicators:

• Platts62 $133.45, -2.15, MTD $130.43. There were massive seaborne trades after the past three quiet trading days. NHGF was traded at $133.75. PBF was traded at January IODEX + $2.1, which looked conservative compared to the $2.25 in early November given a lower index by then. The float premium narrowing as well as cautious pricing on fixed trade indicated a potential reversal in physical market.

• During the week from November 20th to 26th, Australia and Brazil total delivered 26.526 million tons of iron ore, down 9,900 tons on the week. There were 25.16 million tons of iron ore arrived at 45 Chinese ports, up 1.255 millions on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 27th)

• Futures 141,326,400 tons(Increase 1,119,300 tons)

• Options 123,394,100 tons(Increase 680,500 tons)

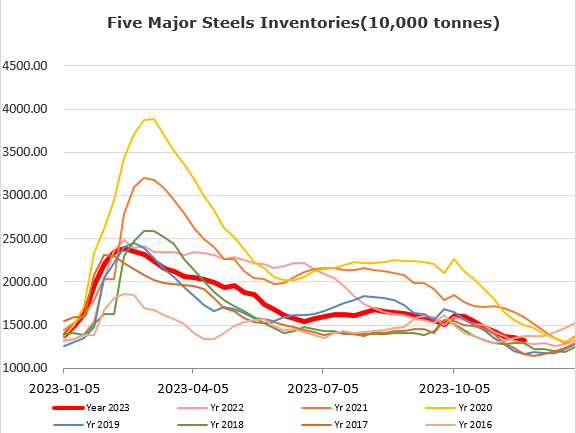

Steel Key Indicators:

• The second biggest steel making province in China, Shandong expected to produce 76 million tons of crude steel in 2023, to realise the “zero growth” target.

Coal Indicators:

• Shanxi Lvliang, one of the biggest premium coal mine areas in China, will start a 3-month length strict safety check to prevent the happen of accidents.