Market Verdict on Iron Ore:

• Neutral.

Macro

• The warfare between Russia and Ukraine blocked the transportation on eastern Europe areas and ports in Black Sea. Ships clearance and safety were both in great concerns. Supply on bulk commodities regionally impacted Eastern Europe areas.

• China NDRC and Market Supervision Bureau started joint research in DCE, analyzing the iron ore market conditions and investigating in the abnormal tradings, improving the futures market regulation.

Iron Ore Key Indicators:

• Platts62 $133.45, (-3.50), MTD $142.16. Ukraine iron ore producers were in general impacted by the warfare. Ukraine was the third largest pellet producers of the world, the warfare greatly impacted the pellets export to Asia, U.S. and eastern Europe area. Russia monthly produced 6.5 million tons of steels, Ukraine produced 1.8 million tonnes of steels. Both countries were also big steel exporters to Europe market.

• Vale announced the FY2021 net gains of 22 trillion U.S. dollars, up 17.6 trillion U.S. dollars y-o-y. Iron ore production increased from 322 million tonnes to 340 million tonnes. Vale expect iron ore production reach 370 million tonnes in the year 2022.

• Nippon Steel Corp planned to purchase more alternative iron ores from non-OZ and Brazil countries to counter against the potential supply disruption on iron ore.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 25rd)

• Futures 95,841,600 tonnes(Increase 961,700 tonnes)

• Options 60,578,400 tonnes(Increase 891,500 tonnes)

Steel Key Indicators

• China surveys on downstream projects indicated that the recovery rate after Chinese New Year was 17.3% lower than last year during same period. Infrastructure recovery was faster than housing projects.

• Tangshan Fengxun Area started a pollution related production curb from February 27 – 28th.

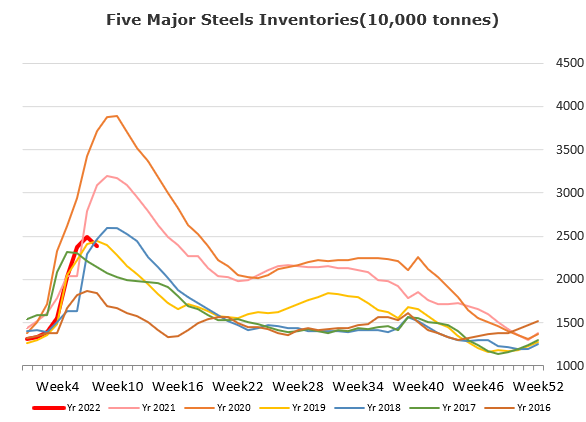

• Steelbank: Construction steel city inventories 8.91 million tonnes, up 5.03% y-o-y. HRC inventories 2.97 million tonnes, down 7.38% w-o-w.