Verdict:

• Short-run Neutral.

Macro:

• According to Bloomberg news, BHP Group Ltd., the world’s biggest miner, has embarked on a major restructure of its global business, affecting units from mine-planning to decarbonization and heritage protection.

Iron Ore Key Indicators:

• Platts62 $116.90, -1.30, MTD $125.27. The virtual steel margin recovered from 30 yuan/ton last week to 90 yuan/ton today as the sharp drop on both coke and iron ore. The trend is upward on the futures margin, however it takes some time to see recoveyr on physical market since the iron ore inventories at steel mills were bought in high cost in January. The market was waiting for acceleration on construction projects next week. There were two PBFs trades including a fixed trade and a float basis trade after being quiet for almost a week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 28th)

• Futures 116,322,100 tons(Increase 561,600 tons)

• Options 127,471,800 tons(Increase 1,710,000 tons)

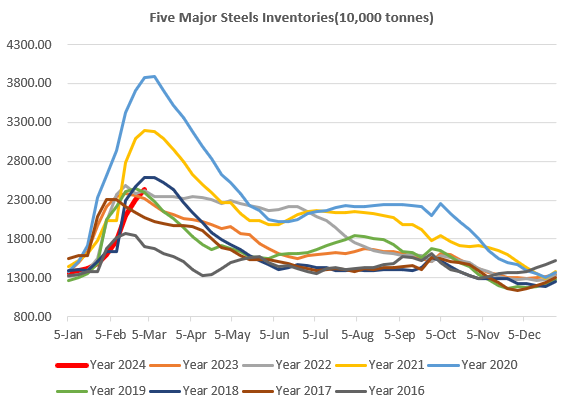

Steel Key Indicators:

• Tangshan average billet cost at 3706 yuan, down 58 yuan/ton on the week, average loss at 156 yuan/ton, widened by 68 yuan/ton.

Coal Indicators:

• Ther was a bid on globalCOAL at $290/mt FOB for 40,000mt of Australian PLV loading April 11-20th for Peak Down and Saraji. End-users were concerning about the sustainability of current price level.