Market Verdict on Iron Ore:

• Neutral.

Macro:

• China BO’AO Asian Forum expected Asian countries potentially contribute a 4.5% GDP growth in 2023.

Iron Ore Key Indicators:

• Platts62 $123.7, +2.05, MTD $127.10. The iron ore market was back to normal as the risk appetite shift back. Physical trades on both float and fixed improved significantly. BHP sold MACF at $120.3. Rio Tinto sold a fixed price laycan for PBF at $121.6, and two laycans of premium at $1.4 based on May IODEX. There were increasing IOCJ trades during past 2-3 weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 28th)

• Futures 107,666,200 tons(Increase 447,500 tons)

• Options 111,349,100 tons(Increase 1,807,500 tons)

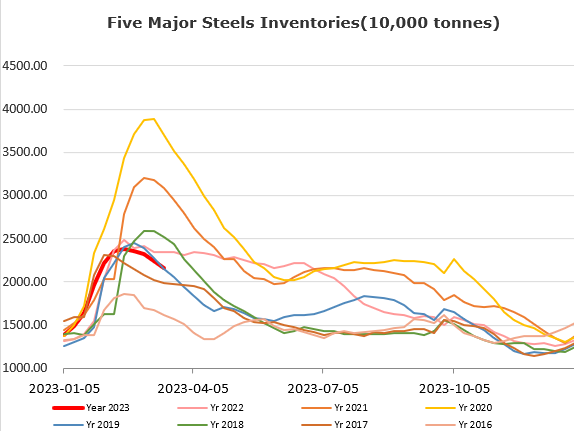

Steel Key Indicators:

• China has completed low emission transformation on 207 million crude steel capacities, and expected 40 million crude steel capacities could be completed in Q1 2023.

Coal Indicators:

• Australia FOB market saw correction by seeing softened offers and less bids on the market. Secondary quality coals are surplus on this market.