Market Verdict on Iron Ore:

• Neutral.

Macro:

• US House Speaker Kevin McCarthy stated that the White House and Republican have reached an agreement in principle on the debt ceiling.

• From January to April, China industrial enterprises value added amount down 20.6% on the year.

Iron Ore Key Indicators:

• Platts62 $102.45, +4.35, MTD $105.33. Import margin improved fast during the last few days, inducing significant buying interest yesterday on seabornes trading window. There was a PBF bid for June laycan at $1.5/dmt based on June Index. The bid was lower from $1.85 from previous trading day. However there were no sellers saw during late half of ast week. Demand for PBF supported the resilience of the premium and price. However low grade and high grades started to imply a strong cost-efficiency.

SGX Iron Ore 62% Futures& Options Open Interest (May 26th)

• Futures 102,026,200 tons(Increase 655,700 tons)

• Options 113,827,300 tons(Increase 545,000 tons)

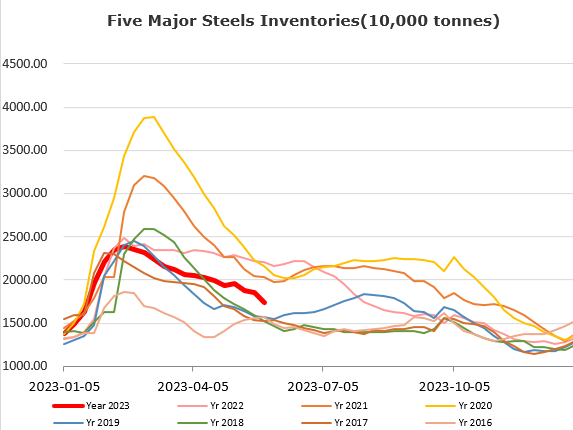

Steel Key Indicators:

• MySteel sample EAFs average cost at 3834 yuan/ton, down 40 yuan/ton on the week. Average loss at 137 yuan/ton.

Coal Indicators:

• China coke traders were waiting for another rounds of price-cut. Thus, most of them were in a watch-and-see mode.

• Australia coking coal market started to maintain flat, however market participants were expecting a bearish market.