Market Verdict on Iron Ore:

Neutral to bullish.

Macro:

National conference from CFXC(China Foreign Exchange Commission) mentioned to stablise foreign exchange market, prevent Chinese yuan from sharp rise or fall. Previously Japan started to release 3.6 trillion Yen to slow down the fast depreciating Yen.

Iron Ore Key Indicators:

Platts62 $99.60, +0.85, MTD $98.93. The trade acitivity in general eased off before golden weeks in China. Lump trade grew as the production restriction on sintering ores in Tanghshan. PBF and NMHG regained popularity, with significantly improved volume in late half of August, however the premium disappeared as the strong U.S. dollar versus Chinese yuan diminish the buying power of import cargoes. CSN sold multiple laycans of IOC6 at October Index with a discount of $4.6- 4.75 during last two weeks, currently market saw improving interest in high silica products.

Some steel mills received notice to restrict production according to different environment scores. A scored steel mills are required to cut sintering by 30%. Below A scored mills are required to cut 50%. However most of mills indicated that they have at least 7-8 days of sintered ores inventories.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 28th)

Futures107,178,500 tons(Increase 576,100 tons)

Options 92,948,100 tons(Increase 809,000 tons)

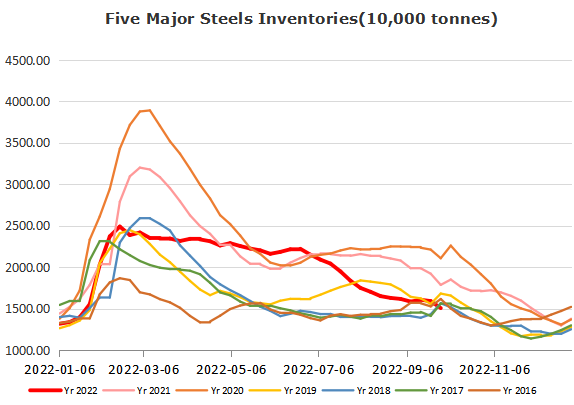

Steel Key Indicators:

Tangshan major steel mills average cost 3747 yuan/ton, up 6 yuan/ton. Average loss at 47 yuan/ton, down 84 yuan/ton.

Coal Indicators:

Bid and offer ranged from $266 -277 in Peak Downs area. Two laycans of 75,000mt and 80,000mt of globalCOAL HCCLV Peak Downs offer at $266-267, following with no inquiries.