Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• China Ministry of Industrial Information Technology vice chairman indicated that they have complied an implementation plan on non-ferrous, construction materials and petrol-chemical industry. At the same time, the new built capacity will be controlled.

• China central bank PBOC: China financial system was generally stable. The lending rate for enterprises was below 5% in average, creating the new low historically. The Minister of Finance said the department will devoting in decrease taxes in the year 2022 and increase the market dynamism.

Iron Ore Key Indicators:

• Platts62 $117.7, -$7.35, MTD $111.62. Both seaborne and port iron ore price correct massively before and after Christmas. However current iron ore majorly follow the China winter stock strategies, which have a specific impact on marginal supply. MACF was the most popular seaborne trades during the last two weeks, PBF has very few interests in the entire December.

• Bloomberg: Anglo American confirmed they had preliminary discussion about jointly developing Vale’s Serpentina iron ore resource, which is contiguous to Anglo American’s integrated Minas-Rio iron ore operation in Brazil.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 28th)

• Futures 97,325,200 tonnes(Increase 831,600 tonnes)

• Options 64,430,500 tonnes(Increase 147,000 tonnes)

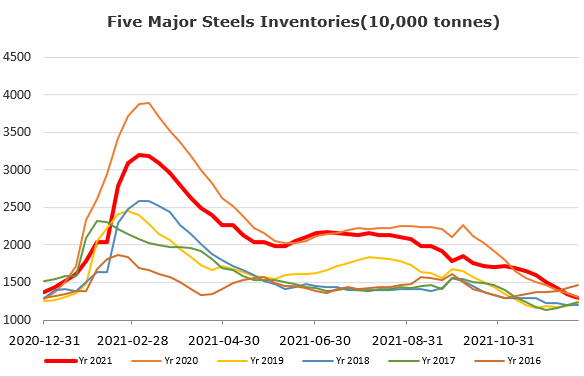

Steel Key Indicators

• 19 provinces of China elimiateed 76.53 million tonnes of capacity and built 76.44 million tonnes of new capacity.

• Ganggu Construction Steel Inventory: production 3.85 million tonnes, down 0.09% w-o-w. Mills inventory 2.46 million tonnes, up 1.86% w-o-w. Circulation inventory 4.98 million tonnes, down 2.96% w-o-w.