Market Verdict on Iron Ore:

• Neutral.

Macro

• G7 countries refused to pay Russian gas in Rubles.

• OPEC+ indicated that they will maintain moderate increase on production.

Iron Ore Key Indicators:

• Platts62 $152.40, +1.60, MTD $149.99. Iron ore portside and seaborne both saw much higher offers on last Friday as trade sources indicated that mills are confident on the pandemic recovery in Tangshan, although Shanghai was still in a quiet mode with limited industry activities because the daily new added patients are refreshing higher numbers. Tangshan mills started to asking for raw material bids and preparing to increase the mills inventories step by step. Otherwise they will have to suspend the operation on blast furnace. MACF is the most popular mid-grade since the cost-effective to mills. Heavy discount fines and low grade are still major trades on seaborne market as well as portside market. MACF discount was narrowed fast at $9.9 on May laycans, and 3-4 laycans of fixed price trades during the past two weeks.

• The Guinean government has signed an agreement with two groups of iron ore Simandou project, and the operation of the project may resume. After the project was suspended for two weeks, the Guinean government, Win Alliance (WCS) and Rio Tinto simfer signed a 35 year infrastructure agreement. Earlier, the Guinean government suspended the project after saying that the two development groups failed to make progress in the financing negotiations for the local port and railway.

• DCE iron ore May22 and Sep22 futures margin level increased from 12% to 15% started from the night session of 29th.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 28th)

• Futures 89,382,200 tonnes(Decrease 532,600 tonnes)

• Options 92,528,800 tonnes(Increase 680,000 tonnes)

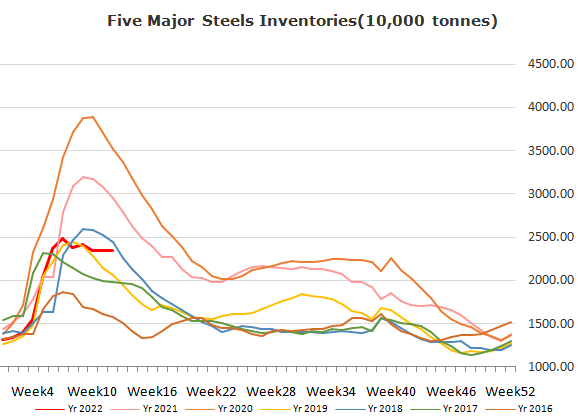

Steel Key Indicators

• Five Tangshan steel mills iron ore inventories useable days at 1-3 day, the other mills useable days above 5 days. In general most of mills are short of raw materials if not planning for maintenance.

• India and Turkey steel mills started to sell $110- 220/mt lower than local steel mills ex-factory offer in European areas, the laycans expected to arrive Europe in the current weeks.

Coal Indicators

• India is likely to continue to increase importing coking coal from Russia and is considering it, Union Steel Minister Ramchandra Prasad Singh said on Sunday.