Market Verdict on Iron Ore:

• Neutral.

Macro

• Chinese offshore yuan CNH depreciated 700 basis points at 6.66, dragged by the weakening of Japanese yen.

• U.S. GDP Q1 growth rate -1.4%, created the first negative number since the Q2 2020, est.+ 1.1%, last +6.9%.

Iron Ore Key Indicators:

• Platts62 $142.00, +1.55, MTD $151.22. PBF cost-efficiency started to return as the miners started to offer discount instead of premium from this April. The discount level narrowed from $1.4 to $1.1 during the late half of April when some traders started to inquire on the cargoes. However the major interest was still remained on JMBF and SP10, as both of them are with high phosphorous level, indicating mills are maintaining cost-saving strategy.

• MySteel 45 ports iron ore inventories at 145.18 million tons, down 2.08 million tons w-o-w. Daily evacuation 2.98 million tons, down 104,800 tons w-o-w. Australia iron ore 68.75 million tons, down 1.13 million tons w-o-w. Brazil iron ore 47.82 million tons, down 584,000 tons w-o-w. 109 ships at ports, up 5.

• FMG Q1 production 44.2 million tons, down 10% from last Q4, down 1% y-o-y. FMG increased the annual guidance from 180 – 185 million tons to 185 – 188 million tons in FY 2022.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 28th)

• Futures 84,364,900 tonnes(Increase 740,000 tonnes)

• Options 88,285,500 tonnes(Increase 2,253,000tonnes)

Steel Key Indicators

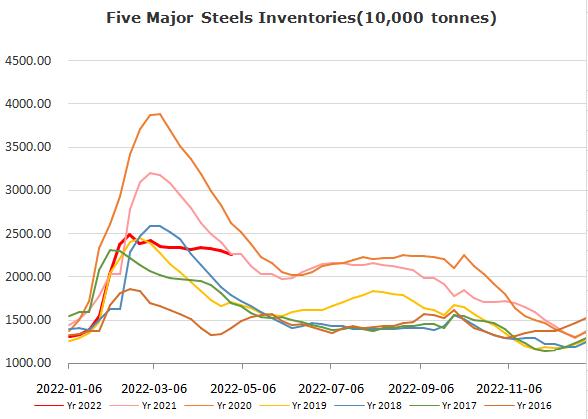

• MySteel Rebar Inventory: Rebar production 3 million tonnes, down 2.01% w-o-w. Mills inventory 3.39 million tonnes, up 1.08% w-o-w. Circulation inventory 8.95 million tonnes, down 3.23% w-o-w.

Coal Indicators

• China Tariff Commission of State Council: remove import tariff on all coals to 0%, effective from May 1st 2022 to March 31st 2023.

• Reuters: India exhorted the states to increase coal imports in the coming three years to satisfy the demand.