Market Verdict on Iron Ore:

· Neutral.

Macro

· U.S. secretary of commerce Gina Raimondo said the cancellation of U.S. – E.U. metal tax would help to counter against U.S. high inflation rate.

· Instituite of International Finance data indicated the interest rate undermined the new funds entry of equity sector in new emerging market, however the money flow into China significantly increased.

Iron Ore Key Indicators:

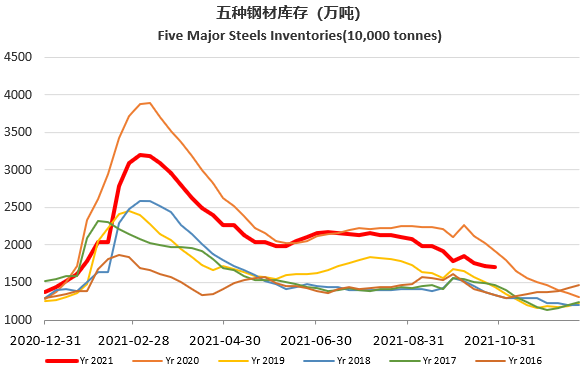

· Platts62 $96.45, -6.85, MTD $99.88. Iron ore dump in early half of the week was majorly due to the money taking out effect in ferrous sector followed by coal and steel. However market tend to slow down this morning as DCE Jan contract approached the domestic miner cost around 550- 600 yuan area. In addition, many China domestic miner will close earlier for safety inspection before Chinese New Year. SGX iron ore monthly spread across Dec 21 to May 22 were weak in $0.8- 0.95, which was a historical low area based on a $96 index value. DCE jan -may spread was only 3.5 yuan during this morning. However current iron ore stocks at highest of five-year level during same period, and low mills production efficiency all pulled back demand of iron ore market in this Q4.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 2nd)

· Futures 61,380,400 tonnes(Increase 818,900tonnes)

· Options 59,719,500 tonnes(Increase 960,000tonnes)

Steel Key Indicators

· Handan started a new round of production curb from Nov 1 – 7th, estimated impact 89,800 tonnes of pig iron production on daily basis.

· Ganggu Construction Steel Inventory: production 4.64 million tonnes, down 227,500 tonnes w-o-w. Mills inventory 4.85 million tonnes, up 359,300 tonnes w-o-w. Circulation inventory 7.85 million tonnes, down 204,600 tonnes w-o-w.

Coal Indicators

· China NDRC revealed many state-owned miners decrease 5500 kcal thermal coal to below 1000 yuan/tonne. NDRC expected market would return to fundamental side in short-run.

· China Zhengzhou Commodity Exchange decided to increase margin ratio of thermal coal futures Jan22 to 50%, which is the highest level of commodity futures historically.

· China domestic physical coke started the first round of price decrease by 200 yuan/tonne in Q3 yesterday.