Market Verdict on Iron Ore:

· Neutral.

Macro

· China automobiles association estimated November China auto sales 2.47 million, up 5.95% m-o-m, down 10.8% y-o-y.

· OPEC+ draft indicated January daily production increased by 400,000 barrels. OPEC+ potentially adjust production increase schedule when market changes.

Iron Ore Key Indicators:

· Platts62 $98.35 (-3.05), MTD 99.88. Seaborne market saw very active trading, 6 laycans of MACF with same discount at $10.2 based on Platts62% January were traded during the current two weeks. SGX Dec-Jan spread become negative since December production restriction was harsh, however January production was not strictly controlled.

· MySteel 45 ports iron ore inventories at 154.57 million tonnes, up 2.05 million tonnes w-o-w. Daily evacuation 2.76 million tonnes, down 53,200 tonnes w-o-w. Australia iron ore 71.63 million tonnes, up 854,500 tonnes w-o-w. Brazil iron ore 55.62 million tonnes, up 355,000 tonnes w-o-w. 152 ships at ports, down 6.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 2nd)

· Futures 75,753,700 tonnes(Increase 2,041,900 tonnes)

· Options 52,991,000 tonnes(Increase 565,000 tonnes)

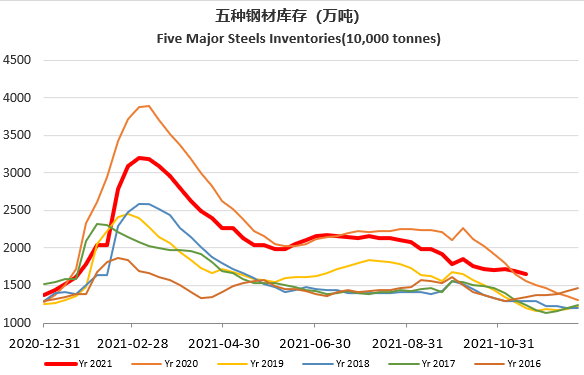

Steel Key Indicators

· Mysteel researched 247 blast furnace operation rate at 69.79%, up 0.14% w-o-w. Utilisation rate 74.8%, down 0.43% w-o-w. Daily pig iron production 2 million tonnes, down 11,700 tonnes.

Coal Indicators

· China Mongolia port Ganqimaodu daily cleared 98 coal trucks. The other major coking coal export port Ceke expected to close this year according to customs sources.