Market Verdict on Iron Ore:

• Neutral.

Macro:

• Market expected that the new emerging potentially start interest cut this year.

Iron Ore Key Indicators:

• Platts62 $104.45, +2.00, MTD $105.29. The seaborne inquiries became active because of the recovery of import margins. MACF traded at $100.7, increased by near $7 compared to last week. Australia and Brazil delivered 24.775 million tons of iron ore last week, down 245,000 tons. Chinese 45 ports total arrived 22.44 million tons of iron ore, up 741,000 tons.

SGX Iron Ore 62% Futures& Options Open Interest (May 29th)

• Futures 103,688,600 tons(Increase 1,662,400 tons)

• Options 117,479,800 tons(Increase 3,652,500 tons)

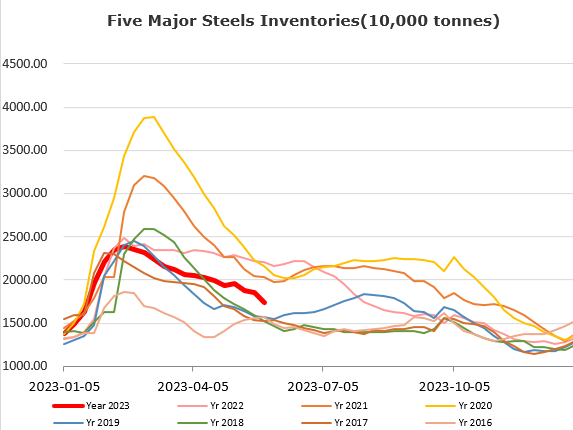

Steel Key Indicators:

• World Steel Association statistic indicated that global crude steel production down 2.4% to 161.4 million tons. Jan-Apr global steel production down 0.3% to 622.7 million tons.

Coal Indicators:

• Australia coking coal potentially supported by the resilient Indian restock in June. In addition, the laycans became less in late June, which eased the over-supply condition.