Verdict:

• Short-run Neutral to Bullish.

Macro:

• US jobless claims past week reached 231,000, est. 232,000, last 232,000.

Iron Ore Key Indicators:

• Platts62 $101.25, +0.80, MTD $98.63. There were many fixed trades and premium concentrates traded during this week, indicating a strong restocking. Thus, price gained support from current level. MACF trade fell out of platts assessment window. The Fe61% PBF was traded at $100.7/mt, slight higher if normalised to 62% ferrous content, which was roughly equal to the index growth yesterday. NHGF was traded at $98.4, significantly up from $95 traded last week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 29th)

• Futures 148,236,500 tons(Increase 1,933,400 tons)

• Options 169,290,700 tons(Increase 1,292,600 tons)

Steel Key Indicators:

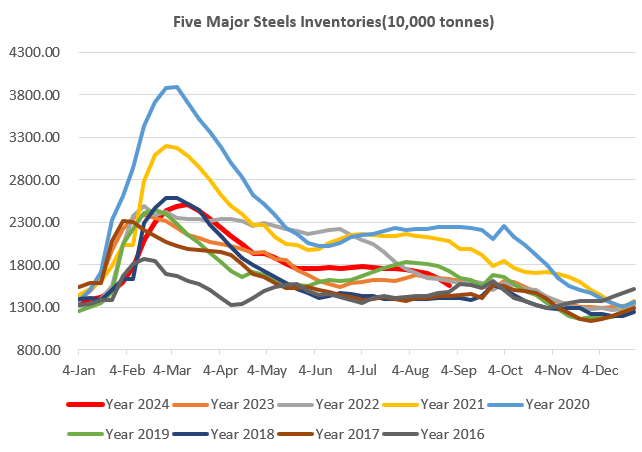

• Rebar total inventories down 8.61% on the week, while production only increased slightly by 1%. The strong fundamental supported steel price.

• Blast utilisation rate at 82.96%, down 1.34% on the week, down 9.31% on the year.

Coking Coal and Coke Indicators:

• After the seventh physical coke price cut landed, some market participants expected a price hike in the next week.