Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• Before Chinese Golden Weeks, many cities start signing major projects, with a total investment of 3163.9 billion yuan.

• The number of new claims for unemployment benefits for the first time last week was 193,000, est. 215,000, last 213,000. The U.S. economy growth rate at -0.6% in the second quarter, estimated -0.6%.

• Offshore Chinese yuan appreciated more than 1700 bps from 7.2672 to 7.0964 during the last three days.

Iron Ore Key Indicators:

• Platts62 $95.85, +0.35, MTD $98.42. The trade acitivity in general eased off before golden weeks in China. Lump trade grew as the production restriction on sintering ores in Tanghshan. PBF and NMHG regained popularity, with significantly improved volume in late half of August, however the premium disappeared as the strong U.S. dollar versus Chinese yuan diminish the buying power of import cargoes. CSN sold multiple laycans of IOC6 at October Index with a discount of $4.6- 4.75 during last two weeks, currently market saw improving interest in high silica products.

• Some steel mills received notice to restrict production according to different environment scores. A scored steel mills are required to cut sintering by 30%. Below A scored mills are required to cut 50%. However most of mills indicated that they have at least 7-8 days of sintered ores inventories.

• MySteel 45 ports iron ore inventories at 130.76 million tons, down 1.0856 million tons w-o-w. Daily evacuation 3.3172 million tons, up 165,800 tons w-o-w. Australia iron ore 58.06 million tons, down 1.02 million tons w-o-w. Brazil iron ore 46.09 million tons, up 108,700 tons w-o-w. 81 ships at ports, down 30.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 29th)

• Futures 108,724,800 tons(Increase 1,075,900 tons)

• Options 97,731,000 tons(Increase 1,715,000 tons)

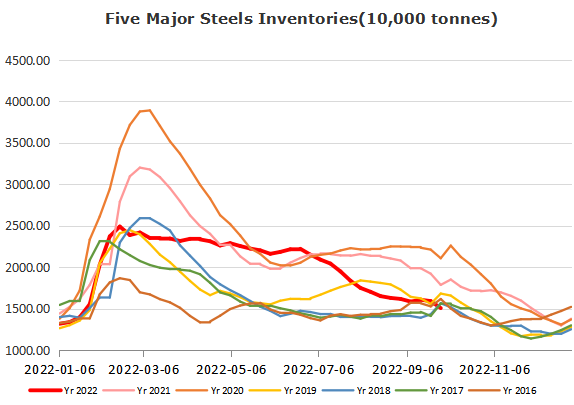

Steel Key Indicators:

• EAFs average billet cost 4205 yuan/ton, up 15 yuan/ton. Average loss at 124 yuan/ton, up 55 yuan/ton.

Coal Indicators:

• FOB Australia coking coal rebounded from $266.5 to $272, saw a trade reported done late at $272/mt FOB Australia for 75,000 mt of a PLV Peak Downs with a Nov. 21-30 laycan which was partially outside Platts’ assessment window.