Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• Germany October CPI up 10% on the year, lower than estimated 10.4%.

• China November official PMI 48, est. 49, last 49.2.

Iron Ore Key Indicators:

• Platts62 $101.25, +2.35, MTD $92.88.China CSRC reopened the refinancing of property companies, the continuous sentiment on the Chinese local bank support house deliveries, supported the continuous growth of ferrous complex. PBF float was stable from $0.46-0.5 this week. The month spread in SGX expected to maintain resilient supported by higher base on outright as well as improved market sentiment on current months.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 29th)

• Futures 123,248,200 tons(Increase 753,400 tons)

• Options 100,119,600 tons(Increase 1,388,000 tons)

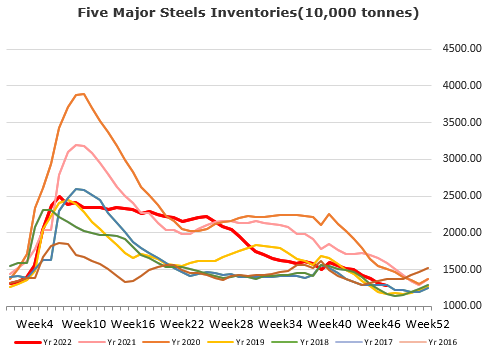

Steel Key Indicators:

• MySteel researched Chinese north-eastern steel winter stocks drop 40% on the year, average cost at 3700 – 3800 yuan/ton for rebar.

• China daily crude steel production 2.57 million tons in October, down 11.2% on the year.

Coal Indicators:

• Australia FOB market consolidated from $245-247 during the current two weeks.Tradable levels were heard in the $240-250/mt FOB Australia for December loading. The index was linked to massive trade at $246.5 for Goonyella PMV at current days. There was offer on January delivery at $252, however enticed no bid.