Market Verdict on Iron Ore:

• Neutral.

Macro

• China PM Li Keqiang held general political conference to delay some income tax incentives, equal to 1.1 trillion yuan of tax cut annually.

• China proposed to increase the self-sufficiency by 35% in copper, 20% in aluminum. In addition, increase scrap ratio by 30% in steel making process.

Iron Ore Key Indicators:

• Platts62 $118.05, +0.35, MTD $111.94. Both seaborne and port iron ore price started to stabilize after a big correction before and after Christmas. However current iron ore majorly follow the China winter stock strategies, which have a specific impact on marginal supply. MACF was the most popular seaborne trades during the last two weeks, PBF has very few interests in the entire December, however traded yesterday in fixed price at $116.2 ( Fe61%). Yesterday saw the most active seaborne trades in the entire December.

• Bloomberg: Anglo American confirmed they had preliminary discussion about jointly developing Vale’s Serpentina iron ore resource, which is contiguous to Anglo American’s integrated Minas-Rio iron ore operation in Brazil.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 27th)

• Futures 97,095,900 tonnes(Decrease 229,300 tonnes)

• Options 64,520,500 tonnes(Increase 90,000 tonnes)

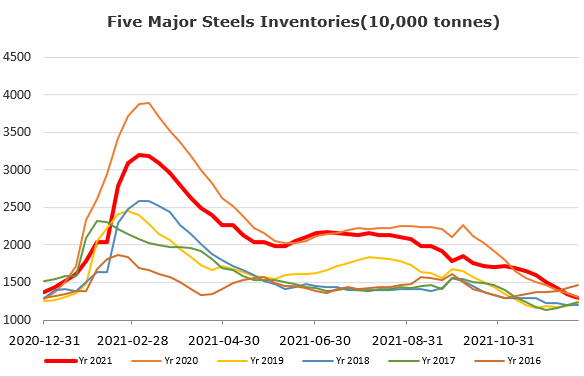

Steel Key Indicators

• China planned to prevent new added capcity in crude steels and cement till the year 2025, and decrease the comprehensive energy consumption by 2% in steel industry.

• China December EAF production 5.08 million tones, decrease massively compared to the 17.33 million tonnes in this may, and 10 million tonnes in last Q4. The expected EAF production would drop to 3.92 million tonnes in next January.