SGX Iron Ore 62% Futures& Options Open Interest (Jul 29th)

· Futures 91,720,000 tonnes(Increase 3,532,700 tonnes)

· Options 86,299,400 tonnes(Increase 700,000 tonnes)

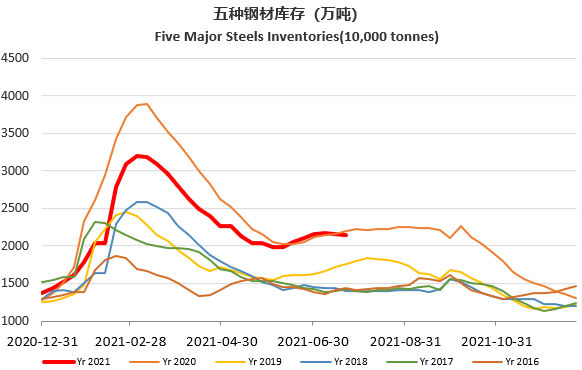

Steel Key Indicators

· The Tariff Commission of the State Council announced that the export of ferrochromium and high-purity pig iron will be appropriately increased from August 1st, 2021, and the export tax rates of 40% and 20% will be implemented respectively after adjustment; The Ministry of Finance announced that from August 1, 2021, the export tax rebate of 23 types of steel products will be cancelled, including cold rolled coil, coated plate, silicon steel, rail and oil pipe. This is the second time of this year that China has adjusted steel tariffs. The total export of cold rolled galvanized steel was estimated to be 1.2 million tons in the second half of last year, down from 5.8 million tons in the same period last year. At present, domestic high-carbon ferrochromium rarely has the opportunity to export for profit. After the policy adjustment, the CIF Cost of domestic low-carbon ferrochromium will be increased by at least 2400 yuan / 60 base tons. In terms of Indonesian stainless steel manufacturers, based on the current market price in China, the cost of a single ton of high-carbon ferrochromium increased by 1800 yuan / 50 base tons compared with the previous period.

Market Verdict on Iron Ore:

· Iron ore short-run bearish.

Macro

· China NDRC: All localities shall implement the peak electricity price mechanism on the basis of peak and valley price range in combination with the actual usage. The theoretical floating proportion of highest electricity price on the basis of peak price range shall not be less than 20%.

· China’s “14th Five Year” industrial green development plan and the “14th five year” raw material industry development plan will be released. At the same time, relevant departments will formulate carbon peak implementation plans for key industries such as nonferrous metals, building materials and iron and steel, and clarify the implementation path of industrial carbon reduction.

· On July 29th, the China State Food and Material Reserve Bureau released the second round of 170,000 tons of copper, aluminum and zinc from the national reserve to the market, previously national reserve released of 100,000 tons of copper, aluminum and zinc on July 5th, to stabilize the sharp rise in the price of industrial raw materials.

Iron Ore Key Indicators:

· Platts62 $195.00, -6.25, MTD $213.57.

· FMG Q2 iron ore production 50.9 million tones, up 14% from Q1, and 19% y-o-y. The Fiscal year 2021 iron ore production was 185.8 million tones, up 5% y-o-y. Fiscal year 2021 iron ore delivery 182.2 million tones, up 2% y-o-y.

· Ancelor Mittal Q2 iron ore production 11.2 million tones, down 15.8% from previous quarter, down 17% y-o-y.

· Mysteel researched 247 blast furnace operation rate at 80.49%, up 1.63% w-o-w. Utilisation rate 79.97%, up 1.16% w-o-w. Daily pig iron production 2.24 million tonnes, up 32,400 tonnes.

· MySteel 45 ports iron ore inventories at 128.13 million tonnes, down 343,400 tonnes w-o-w. Daily evacuation 2.49 million tonnes, up 354,200 tonnes w-o-w.