Market Verdict on Iron Ore:

• Neutral.

Macro:

• China official manufacturing PMI 48.8, est. 49.5, last 49.2.

• Fedwatch tools indicated that the probability of 25bps interest hike in June reached 63%.

Iron Ore Key Indicators:

• Platts62 $102.65, -1.80, MTD $105.16. The mid-grade interests dominate seaborne market yesterday. BHP sold fixed price MACF at $96.6 for 80,000mt Fe60.8%. There were two laycans of PBF traded at June Index + $2.4 and at July Index +$3.5 respectively.

• Pramod Savant, Chief Minister of Goa State in India, stated that iron ore mining in Goa State is expected to resume in 2023-24. Goa has taken measures to auction off iron ore mining areas to resume mining activities.

SGX Iron Ore 62% Futures& Options Open Interest (May 30th)

• Futures 103,314,000 tons(Decrease 374,600 tons)

• Options 118,731,800 tons(Increase 1,252,000 tons)

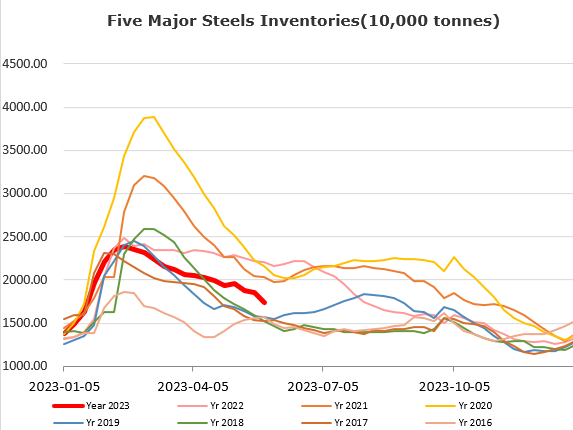

Steel Key Indicators:

• World Steel Association statistic indicated that global crude steel production down 2.4% to 161.4 million tons. Jan-Apr global steel production down 0.3% to 622.7 million tons.

Coal Indicators:

• Australia coking coal potentially supported by the resilient Indian restock in June. In addition, the laycans became less in late June, which eased the over-supply condition. The market heard indicative bid at $227/mt for full Panamax laycan.