Market Verdict on Iron Ore:

• Neutral.

Macro:

• European Central Bank President Christine Lagarde stated that interest rate hikes may be raised or suspended in September. Lagarde said that inflation must return to the target level and interest strategies should became restrictive at a certain level and for a period of time.

• China July manufacturing PMI 49.3, est. 49.2, last 49.

Iron Ore Key Indicators:

• Platts62 $109.40, -3.70, MTD $112.59. Seaborne iron ore market was quiet on last Friday. The current stable steel margin provided support for high and mid grade concentrates. However, in long run, the restriction plan cut off pig iron demand in H2, which provided resistance to iron ore.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 26th)

• Futures 113,525,700 tons(Increase 3,376,000 tons)

• Options 109,683,800 tons(Increase 2,624,500 tons)

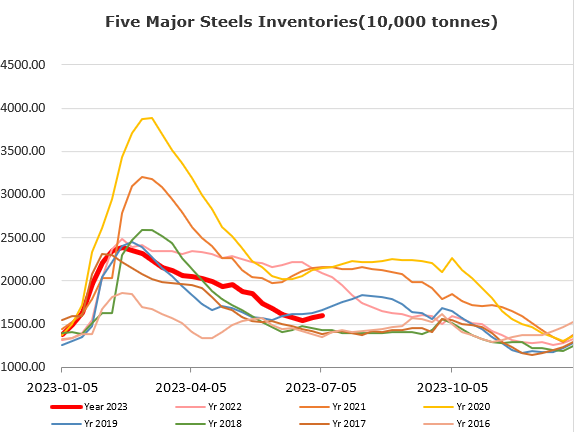

Steel Key Indicators:

• China total crude steel daily production at 3.037 million tons in June, up 4.5% on the year. MySteel estimated that the crude steel daily production in July should maintain above 3 million tons.

Coal Indicators:

• The third round of coke price increase landing in China by 100-110 yuan/ton, three rounds total up 200-220 yuan/ton from June 20th.