Market Verdict on Iron Ore:

• Neutral.

Macro

• ECB official indicated to increase previous interest hike from 50 bps to 75 bps.

• China August Manufacturing PMI 49.4, est. 49.2, last 49.0.

Iron Ore Key Indicators:

• Platts62 $97.60, -4.15, MTD 104.94. Both seaborne and portside market saw a cooling down on buying interest during the week. PBF inventories at Shandong reached 5 million tons, which were 5 times bigger than normal inventories level in previous few years. Thus, PBF sellers expected to complete the deal before landing on ports. The trades potentially shift from sellers’ option to buyers side. NMHG regained popularity. Chinese northern ports has over 6 million tons of pellets, which hasn’t no change since June. Thus there is no import demand either from June.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 30th)

• Futures 104,358,700 tons(Increase 1,743,100 tons)

• Options 102,215,100 tons(Increase 1,170,000 tons)

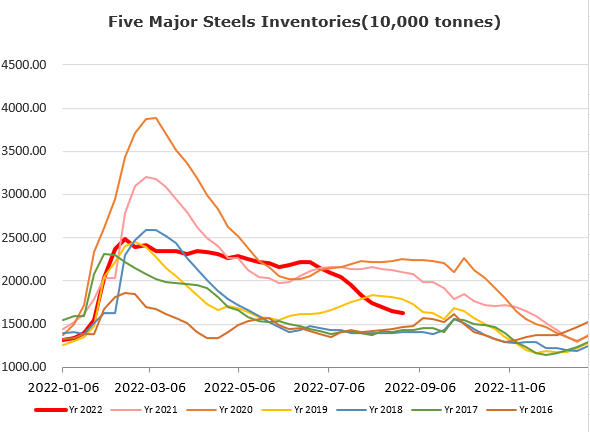

Steel Key Indicators

• 37 Chinese listed steel companies published half-year report. In H1 2022 total realised 1.19 billion yuan, net in come 34.06 billion yuan. 5 out of 37 companies realised net growth, 27 out 37 realised net loss.

Coal Indicators

• Australia met coal saw mixed outlook during the week, since buyers were waiting for new direction. FOB Australia and CFR China PLV index remain flat during the week. India end-users indicated the high coking coal price would stressed their steel margins. China seaborne demand yet to confirm.