Verdict:

• Short-run Neutral.

Macro:

• Canada central bank indicated the resilience of inflation would enable the monetary department to hike interest rate in Q4. ECB indicated that the bank will see current rate enough in December.

• China Manufacturing PMI fell under boom and bust line at 59.5.

Iron Ore Key Indicators:

• Platts62 $122.90, +1.10, MTD $118.71. PBF saw active demand in market after a significant decrease on the premium for December cargoes from $5.5 to $4.1 last week. The premium recovered to $4.4 in early this week. The market also saw some fixed trades on PBF as well. The impact of BHP strike was uncertain so far, while market participants are worried about the escalation of the event.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 30th)

• Futures 144,718,700 tons(Increase 1,392,800 tons)

• Options 125,743,600 tons(Increase 626,000 tons)

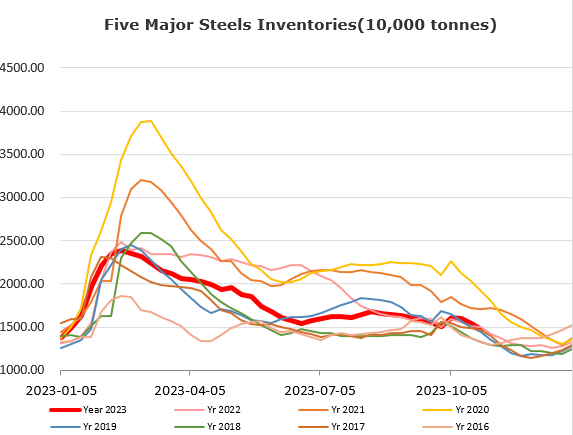

Steel Key Indicators:

• MySteel surveyed 692 mills in China, among which 70% of the mills were expecting to start winter stock around or below 3500 yuan/ton for rebar. The current Shanghai 25mm width spot rebar ex-factory was sold at 3875 yuan/ton.

Coal Indicators:

• The FOB Australia market index was stable with an offer at $350 and current bid at $345 level.

• China steel mills in Hebei province started to propose a 100-110 yuan/ton decrease on coke price, effective from Oct 31st.