Market Verdict on Iron Ore:

• Neutral.

Macro

• China PM Li Keqiang held general political conference to delay some income tax incentives, equal to 1.1 trillion yuan of tax cut annually.

• China proposed to increase the self-sufficiency by 35% in copper, 20% in aluminum. In addition, increase scrap ratio by 30% in steel making process.

Iron Ore Key Indicators:

• Platts62 $122.90, +3.40, MTD $121.20. Seaborne trades saw the most busy day compared to the last two months since the after New Year delivery recovery as well as a consensus on market warming. China northern rebar profit margin was stable at 450-500 yuan/tonne area during the last two weeks. The SP10 fines was slight oversupplied at ports and mills, which pulled down JMBF price with a steep discount at 37% based on January IODEX. Currently major mid-grade iron ore such as Newman, MAC fines and PBF became popular.

• World steel statistics indicated that global iron ore import reached 1.66 billion tones. China import in the year 2021 at 1.17 billion tones, 70.57% of global imports. China was still the biggest buyer of Australia and Brazil. China expected import around 70% of global iron ore in the year 2022.

• Brazil steel maker Usiminas iron ore production reached 9 million tones in the year 2021.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 4th)

• Futures 74,725,000 tonnes(Increase 1,003,400 tonnes)

• Options 38,028,000 tonnes(Increase 285,000 tonnes)

Steel Key Indicators

• Mysteel researched 126 blast furnace in Tangshan, from Jan 1st to Jan 4th, 13 blast furnace recovered operation equivalent to total 44,100 tonnes of pig iron production.

• China 71 EAFs average operation rate at 47.21%, down 1.67% w-o-w, down 23.1% y-o-y.

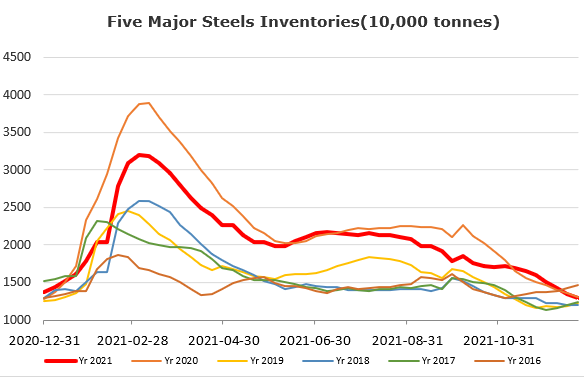

• Ganggu Construction Steel Inventory: production 5.26 million tonnes, down 50,200 tonnes w-o-w. Mills inventory 4.81 million tonnes, up 350,300 tonnes w-o-w. Circulation inventory 5.598 million tonnes, up 23,200 tonnes w-o-w.

Coal Indicators

• Indonesia’s Ministry of Energy and Mineral Resources will reassess the decision of export ban on coals in Jan 5th. China CITIC Securities believed that China will be able to fill the import gap from Indonesia by increasing imports from other countries.