Market Verdict on Iron Ore:

• Neutral.

Macro

• In 2022, economists of some financial institutions in China generally believe that there are three main driving forces for promoting economic growth: investment in infrastructure construction is expected to rebound. Manufacturing investment is expected to continue to increase. Consumption is expected to continue to grow.

• U.S. FOMC meeting indicated that U.S. potentially increase interest rate in advance. In addition, U.S. also accelerate unwinding balance sheet. The interest rate raise probability reached 80% in March. Nasdaq Index created the biggest single day drop by 3.35% over the past 10 months.

Iron Ore Key Indicators:

• Platts 62%: $125.35 (+2.45) MTD $122.58. JMBF discount recovered from two iron ore index average minus $23.05 to minus $22.2, indicating currently discount iron ore was popular on ports areas. However JMBF was also resisted by the oversupply of SP10 fines. Major stream iron ore for example PBF and MACF saw some increasing interest from Tuesday and Wednesday.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 5th)

• Futures 76,132,900 tonnes(Increase 1,407,900 tonnes)

• Options 38,375,500 tonnes(Increase 347,500 tonnes)

Steel Key Indicators

• China stopped new capcity in crude steels and cement till the year 2025, and decrease the comprehensive energy consumption by 2% in steel industry.

• Tangshan billet cost 4011 yuan/tonne, up 34 yuan/tonne w-o-w. Average steel margin 249 yuan/tonne, down 444 yuan/tonne w-o-w

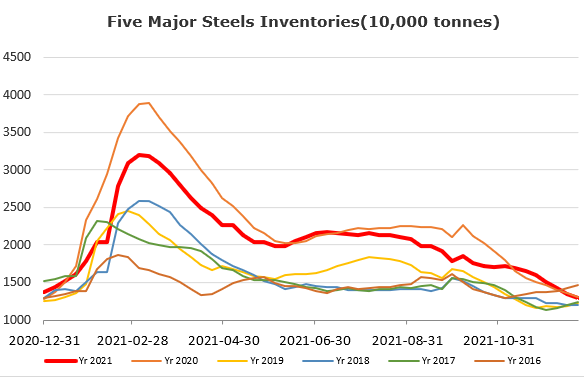

• MySteel Rebar Inventory: Rebar production 2.44 million tonnes, down 5.97% w-o-w.Mills inventory 7.14 million tonnes, up 14.61% w-o-w. Circulation inventory 11.71 milliontonnes, up 17.46% w-o-w.

Coal Indicators

• According to Mysteel, China coking capacity is planned to be eliminated by 54.93 million tons in the year 2022, the planned new coking capacity is 71.6 million tons, and the net new coking capacity is expected to be 16.67 million tons. Considering the impact of reducing the “two high pollution projects policies”, the coking capacity is expected to reach 550 million tons by the end of 2022, the output of metallurgical coke is expected to be 421 million tons in 2022.