Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Li Keqiang indicated to explore and develop carbon emission industry and environment protection industry, and control high energy consumption and emission.

· U.S. new added job roles 235,000, estimated 733,000, last 943,000. The significant low expectation would potentially slow down the exit of T-Bond purchase of the government.

· Guinea coup potentially intensify the supply of Aluminum and the development of iron ore Simandou projects.

Iron Ore Key Indicators:

· Platts62 $145.05, +5.35, MTD $142.77.

· Luo Tiejun, vice president of China Iron and Steel Association, said that recently, relevant departments are learning and supporting the improvement of domestic iron ore capacity, and the CISA will cooperate closely with this project and ensure the majority of iron ore enterprises to increase the output of domestic iron concentrate by more than 100 million tons during the 14th Five Year Plan period.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 3rd)

· Futures 72,119,800 tonnes(Increase 1,330,300 tonnes)

· Options 73,001,500 tonnes(Increase 1,181,500 tonnes)

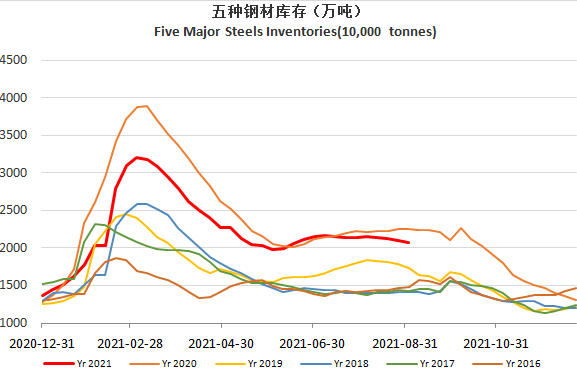

Steel Key Indicators

· Steelbank construction steels inventory 7.73 million tonnes, up 2.19% w-o-w. HRC inventories 2.74 million tonnes, down 0.98% w-o-w.

· Handan September and October protection potentially impact 13,700 tonnes of daily pig iron production.

Coal Indicators

· DCE decided to increase coking coal and coke margin level from 11% to 15%,effective from Monday settlement.

· China Energy Bureau required Inner Mongolia area to inspect in the fast growth of coking coal and coke prices.