Market Verdict on Iron Ore:

• Neutral.

Macro

• The weekends news about U.S. and European countries potential stop import Russian crude oils lifted NYMEX WTI price by 10% in Asian morning on Monday, WTI futures reached $130.5 as the highest of the day.

• China government report mentioned expected to decrease deficit ratio from 3.2% to 2.8%, maintain GDP growth rate at 5.5%, issue local debts 3.65 trillion yuan, support new energy automobiles and green electrical appliances in to country and suburb areas.

Iron Ore Key Indicators:

• Platts 62%: $145.00 (+0.55) MTD $144.73. Physical buyers currently prefer to trade port sources. Chinese domestic iron ore supply increased gradually, which could decrease the demand for low aluminum Brazil sources and Yandi Fines. Indian pellets premiums are still rising due to the shortage caused by Ukraine supply. May-June 22 spreads bounced on the back of low area at $0.20- 0.30 to $0.65-0.75 with in the four trading days as expected. If outright corrects or stable, iron ore spreads are still expected to maintain a wide range since the spreads were reasonable even at $1-1.5 considering the absolute high outright prices.

• Deputy Director of China NDRC, said at the press conference of the state information office on March 7th that China should strengthen domestic exploration and development of iron ore, accelerate the construction of mineral product bases, expand the renewable resources such as scrap steel, enhance domestic resource capacity, strengthen import and export regulation, and resolutely curb the over- development of high energy consumption and high emission projects, Promote the safe supply and stable prices of important mineral products.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 4th)

• Futures 80,695,500 tonnes(Increase 1,431,300 tonnes)

• Options 71,376,700 tonnes(Increase 13,570,800 tonnes)

Steel Key Indicators

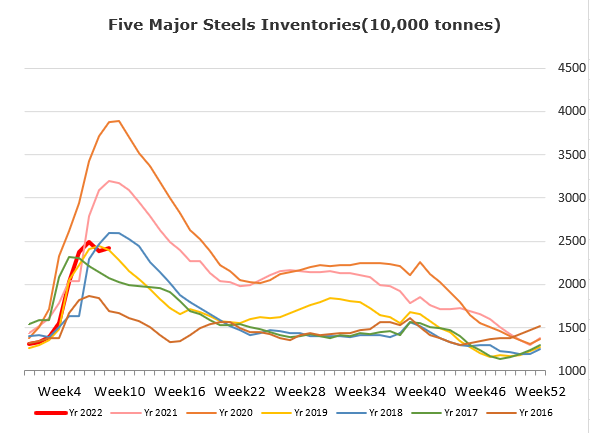

• Steelbank construction steel inventories 8.90 million tonnes, down 0.09% w-o-w. HRC inventories 2.96 million tonnes, down 0.3% w-o-w.

• China Customs: January and February of the year 2022: China import Steel 2.21 million tonnes, down 7.9% y-o-y. Export 8.23 million tonnes of steel, down 18.8% y-o-y. Iron ore import 181 million tonnes during the period approximately flat. Coal import 35.39 million tonnes, down 14% y-o-y.

Coal Indicators

• China Ganqimaodu port cleared 159 trucks yesterday, up significantly compared with 100-110 trucks in February since the increasing demand from China northern steel mills and tight supply on domestic coals.