Market Verdict on Iron Ore:

· Bullish.

Macro

· U.S. increased 194,000 jobs in September, which was significantly below expectation around 500,000 jobs increase, previous number was increase by 235,000 jobs.

· China PM Li Keqiang held conference to ensure the winter and early spring supply and coal and electricity. The conference widened the floating range of electricity price from 10-15% to 20%. Some high energy consumption enterprises could be exempted from this category.

Iron Ore Key Indicators:

· Platts62 $125.05, +7.25, MTD $118.88.

· 64 China steel mills sintered iron ore turnover in 14.71 million tonnes, with 24 useable days.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 8th)

· Futures 67,153,500 tonnes(Increase 884,400 tonnes)

· Options 81,031,500 tonnes(Increase 512,500 tonnes)

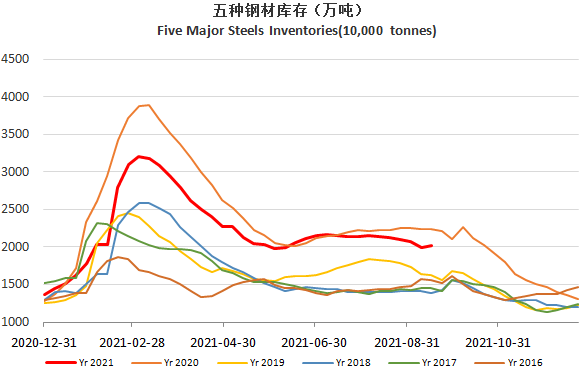

Steel Key Indicators

· MySteel surveyed 91 blast furnace steel mills rebar after tax cost at 4840 yuan/tonne, up 142 yuan/tonne w-o-w. Rebar steel margin 801 yuan/tonne, up 3939 yuan/tonne w-o-w.

Coal Indicators

· China Coal Miners: Mongolia has approved 98 million tonnes of annual new coal capacity. Shanxi approved 28.68 million tonnes of annul coal capacity increase. Shaanxi Yulin sent notice that 26.62 million tonnes of capacity will be maintained as a major supply source of coals. Henan province started a national coal reserve with 3.7 billion yuan investment, with 20 mtpa.