Market Verdict on Iron Ore:

· Neutral.

Macro

· China PBOC RRR released four positive signals including the stable economy growth, hedge the downside risk of economy, create a beneficial monetary environment for enterprises and indicate a manageable liquidity policy.

· The two parties of U.S. reached a consensus to increase the maximum debt ceiling to 2 trillion U.S. dollars.

Iron Ore Key Indicators:

· Platts62 $108.55 (+8.15) MTD $101.44. Seaborne market become quiet again after a temporary active trades over past two weeks. Steel mills were conservative on the production schedules, which created a bottleneck on marginal demand for iron ores. However back month spreads become stronger, indicating the resilience on the next Q1 and Q2.

· China Customs: iron ore January to November import 1.04 trillion tonnes, down 3.2% y-o-y.

· The late November major crude steel daily production reached 1.72 million tonnes, down 2.61% from mid-November. Daily pig iron production 1.63 million tonnes, up 1.59% compared with mid-November.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 7th)

· Futures 80,243,000 tonnes(Increase 1,722,600 tonnes)

· Options 55,609,000 tonnes(Increase 230,000 tonnes)

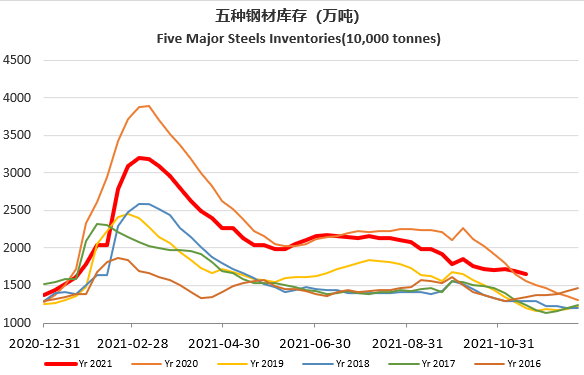

Steel Key Indicators

· Mysteel researched 563 enterprises from upstream to downstream industries. There were 508 new open projects in December, down 15.4% from November. The funds were tight during November with extending days in receivables.

Coal Indicators

· China coal import January to November 292 million tonnes, up 10.6% y-o-y.