Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• EIA indicated that the global oil reserve would reach 240 million barrels in the following six months.

• The European central bank notes indicated that the net asset purchase plan expected a certain date, which could clear the way for the potential interest rate raise in this Q3.

• China Security News: The analysts indicated that the market potentially see interest rate decrease in Q2.

Iron Ore Key Indicators:

• Platts62 $155.05, (-5.15), MTD $159.34. Seaborne market iron ore prices fell as the pandemic uncertainties and period last longer than expected. Some Chinese cities started a very strict transportation policy even with few infected cases. Steel margin narrowed for consecutive weeks from early March which kept mills and traders in a watch-and-see mode. Long-term contracts were few than expected. Some mills sources indicated they have completed the raw materials purchase before mid-April.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 7th)

• Futures 78,847,400 tonnes(Decrease 202,500 tonnes)

• Options 81,884,000 tonnes(Increase 1,400,500 tonnes)

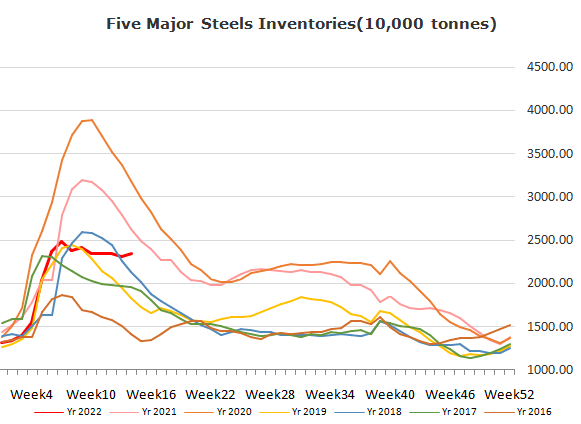

Steel Key Indicators

• Mysteel researched 247 blast furnace operation rate at 79.27%, up 1.82% w-o-w. Utilisation rate 84.95%, up 1.19% w-o-w. Daily pig iron production 2.29 million tonnes, up 32,100 tonnes w-o-w.

• Ukraine steel mill ArcelorMittal Kryvyi Rih and Metinvest are striving to recover production at normal and seeking export opportunities.

Coal Indicators

• FOB Australia coking coal dropped almost 50% from the high at $675 to $396, however China CFR PLV stand firmly at $497 . U.S. coking coal was also considering to shift exports to China where there is a rather resilient CFR price comparing to international market.