Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· China Prime Minister held a conference to facilitate RRR cuts focusing on decrease cost for mid-small capital enterprises. The RRR cuts were not related to a general loose on money supply.

· According to the National Development of Reform Commission’s “14th five year” economy development plan by 2025, the utilisation of scrap steel will reach 320 million tons, and the output of recycled non-ferrous metals will reach 20 million tons, of which the output of recycled copper, recycled aluminum and recycled lead will reach 4 million tons, 11.5 million tons and 2.9 million tons respectively.

Iron Ore Key Indicators:

· Platts62 $222.85, +0.85, MTD $220.47.

· Austsino, a joint venture between China and Australia, has signed a memorandum with the Cameroonian government in Africa and the best finance company in Hong Kong on the joint construction of a railway connecting the mbalam iron mine in Cameroon to the Kribi port. At present, the port’s infrastructure has the capacity to transport and process about 100 million tons of iron ore annually.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 7th)

· Futures 76,268,300 tonnes(Increase 755,600 tonnes)

· Options 77,614,900 tonnes(Increase 1,250,000 tonnes)

Steel Key Indicators

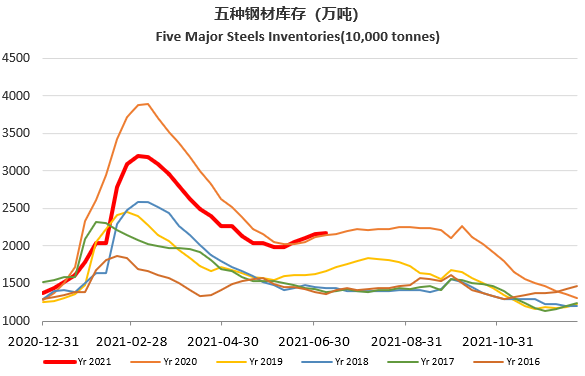

· MySteel Rebar Inventory: Rebar production 3.44 million tonnes, down 2.3% w-o-w. Mills inventory 3.43 million tonnes, down 3.7% w-o-w. Circulation inventory 8.13 million tonnes, up 3.1% w-o-w.

· Tangshan 10 sample steel mills pig iron before tax 3725 yuan/tonne, billet cost 4669 yuan/tonne, up 30 yuan/tonne w-o-w. Gross profit 331 yuan/tonne.