Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· China National Bureau of Statistics: July CPI up 1% from June, up 0.3% y-o-y. July PPI up 9% y-o-y, from 0.5% from August. Jan- July Manufacturing ex-work price up 5.7% y-o-y, Manufacturing purchase price up 7.9% y-o-y.

Iron Ore Key Indicators:

· Platts 62%: $171.20 (+1.15) MTD $178.39

· China July Iron ore imported 88.51 million tonnes, down 21.4% y-o-y. Jan- Jul iron ore imported 649.03 million tonnes, down 1.5% y-o-y.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 6th)

· Futures 74,941,900 tonnes(Increase 686,100 tonnes)

· Options 68,784,100 tonnes(Increase 206,100 tonnes)

Steel Key Indicators

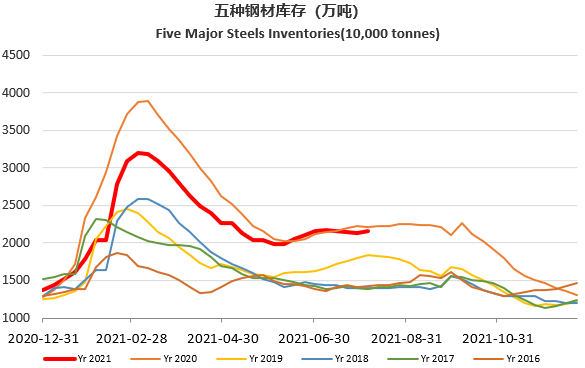

· Steelbank construction steels inventory 7.63 million tonnes, down 1.62% w-o-w. HRC inventories 2.78 million tonnes, up 0.29% w-o-w.

· CISA: China major steel making enterprises daily steel production at 2.11 million tonnes during early July, down 3.97% from mid-July, down 3.03% y-o-y. Iron ore price started to soften as the fall on steel production.

· China Jan- July steel export 43.05 million tonnes, up 30.9% y-o-y. China Jan- July import steel 8.397 million tonnes, down 15.6% y-o-y. China Jan – Jul coal import 169.74 million tonnes, down 15% y-o-y.