A total of 1.39 million mt of iron ores was traded for the week ended Oct 23, down almost 7.33% week-on-week as compared to the 1.5 million mt recorded last week.

The decline in trading volumes was due to slowing steel demand as the peak construction came to end, while trade participants prepared for the winter season ahead.

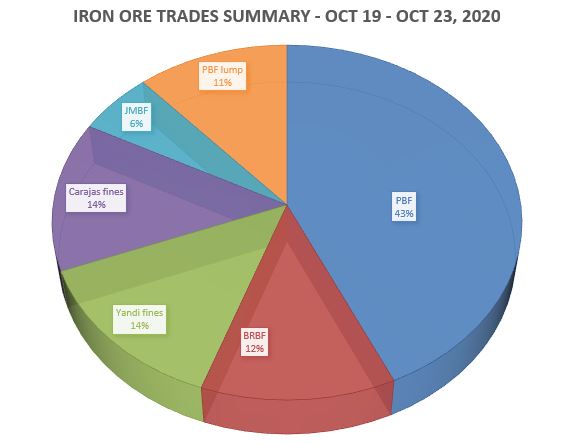

Nevertheless, the Pilbara Blend fines (PBF) accounted most of the market shares at 43%, then followed by Carajas fines at 14%, which tied with Yandi fines at 14%, over the Oct 19 – 23 period.

More price corrections ahead

The high port stockpile continued to place pressure on further upward price movement, as China’s iron ore port inventory reached a high volume of 124 million mt by the end of the week.

Trade participants were unsure how the slowing steel demand are going to absorb the excess iron ores with lesser construction activities as winter season approached in China.

Some of the buyers were heard to wait for further price corrections in mainstream fines before making procurement decisions, while some buyers were heard in seeking non-mainstream products like Gibson fines and lump to save production costs.

Preparing for more sintering cuts ahead

Chinese steel mills were heard to reduce their production costs by using high-low grade combination for blast furnace mix, such as blending high grade Carajas fines with Indian low grade fines.

Yandi fines also became popular among buyers due to its low alumina content, which was useful to comply with sintering cut as end-users prepared for the upcoming winter season.

Moreover, it was heard that some buyers are seeking for more mid-grade Jimblebar fines due to better qualities and lower impurity levels from the recent cargoes.