A total of 1.03 million mt of iron ores was traded for the week ended Jun 11, amid a volatile market with declining steel margins.

However, benchmark iron ore prices soon found some supports from the supply tightness of port inventory and extended output curbs in Tangshan.

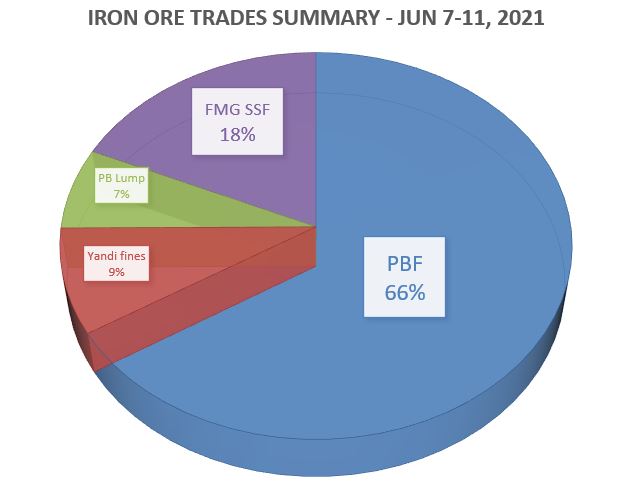

During the week, the trades volume of PBF accounted the largest market share at 66%, then followed by FMG SSF at 18%, and lastly Yandi fines at 9%.

More mills to adopt low-high combination in the blast furnace mix

More mills were heard to seeking more low grade fines to blend with high grade fines in the blast furnace mix for cost savings purposes.

Thus, some of mills with flexible blast furnace mix had moved away from PBF product and sought-after low-grade fines like Yandi Fines and Super Special Fines.

High-grade fines like Carajas fines were sought after as well, though some of the trade participants were in no hurry to purchase as they expected further price corrections for the products as more supplies were heard to arrive in July.

Lump demand continues to grow despite rainy season

The lump demand remained firm and rose in premiums, despite being in the traditional lull demand period of rainy season in China.

Apparently, the supply tightness of lump had supported the prices upticks, though there were market talks of mills moving away from mainstream lump to non-mainstream ones to save costs.

There was also rising market enquiries from Japanese steel mills that supported the lump premiums, amid straining supplies.

Meanwhile, there was also renewed market interests of iron ore pellets for direct feed usage, which can be used as a cost-effective alternative to lump.