A total of 1.16 million mt of iron ores was traded for the week ended Jul 16, after steel output cut was relaxed from early July, which led to more steel consumption and demand.

However, many trade participants saw the relaxation as temporary and expected further production cuts in H2 2021 in effort to cut emission.

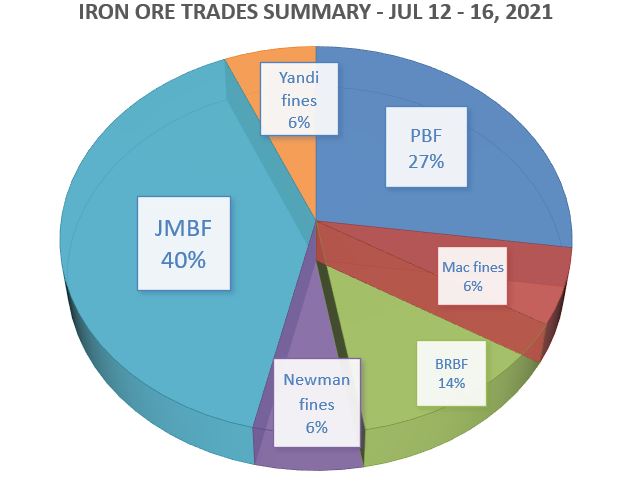

During the week, the trades volume of JMBF accounted the largest market share at 40%, then followed by PBF at 27%, and BRBF at 14%.

Rising popularity of lower-quality medium grade fines

More Chinese mills had adopted lower-quality medium grade fines like Jimblebar fines, as a part of the cost saving measures in the low steel margins environment.

Other lower-quality medium grade fines like Mac fines were also sought after by the Chinese mills, as downstream steel demand softened seasonally due to rainy weather.

There was also much availability of Mac fines in the spot market, as BHP began its South Flank mine for production since June.

More usage of Carajas fines for blending with Jimblebar fines

On the contrary, the supply of Carajas fines remained tight since May, though there might be some easing during the July with more shipment arrivals.

Thus, there had been some softening of Carajas fines especially at ports, while some Chinese mills were heard to be reselling their term Carajas fines volume back to market that alleviated the tight supply situation.

Then, the availability of Carajas fines might support the blending demand of Jimblebar fines to lower its high alumina and phosphorous levels, along with domestic concentrate.