A total of 680,000 mt of iron ores was traded for the week ended Sep 17, down 19.05% on-week, amid price correction phrase for iron ore.

Restocking of iron ore failed to pick up for the week, which typically will see more iron ore procurement ahead of the Golden week in early October.

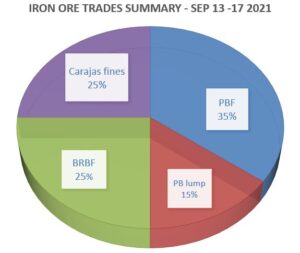

During the week, the trades volume of PBF accounted the largest market share at 35%, then followed by BRBF at 25%, and Carajas fines at 25% too.

More price corrections for medium grade fines

Iron ore demand remained low despite seasonal restocking activities ahead of the Chinese National Holidays in early October, while supply was at higher levels with many October loading cargoes available in the spot market.

Meanwhile, medium grade fines were also pressurized by extended corrections with widening discounts for Jimblebar fines, as seaborne cargoes were heard to be traded in discounts for October arrivals.

Thus, some market participants expected PBF premiums to decline further, in evident of widening discounts level for medium grade ores and falling Mac fines and Jimblebar fines.

Lump premiums struggle to stay afloat

The lump premiums followed the downward trend as well, as demand of lump and pellets as well as fines were affected by the limiting steel production.

Moreover, lump cargoes were also sold in secondary market at discounted levels, despite some stabilization after the recent price corrections.

Overall, lump premium continued to soften with more supply available, while demand was constrained by the lower lump usage in the blast furnaces.