A total of 950,000 mt of iron ores was traded for the week ended Aug 20, up 25% week-on-week, after a week of price corrections.

Iron ore prices continued their correction phrase this week, to the extent of sharp drop to $130.20/mt under Platts assessment of the 62% Fe Iron Ore Index.

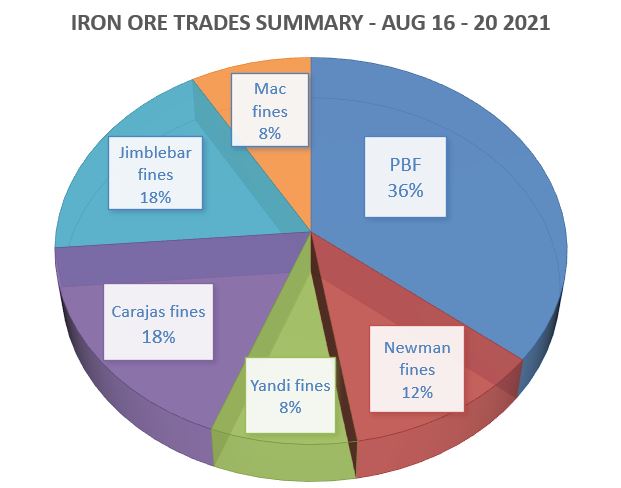

During the week, the trades volume of PBF accounted the largest market share at 36%, then followed by Jimblebar fines at 18%, and Carajas fines at 18% too.

Purchases focus on discounted iron ore fines

Chinese mills were not longer chasing for productivity and preferred discounted iron ore fines like Jimblebar fines, MAC Fines and Super Special Fines for cost savings.

High grade fines and concentrate begun to lose popularity among end-users, though the week saw a purchase of 170,000 mt cargoes of Carajas fines.

Meanwhile, seaborne lump premiums had also weakened, due to soft demand and from excess lump stocks as most mills reduced lump usage in blast furnace operations.

Easing of supplies from more iron ore shipments

The price corrections are likely to continue for some time, due to more Brazilian shipments, as Vale stepped up iron ore output.

As UBS estimated the Brazilian iron ore exports to increase by 26% from the previous week to 8,200 mt, as of Aug 18.

Furthermore, the Brazilian iron ore shipments are up 7% year-on-year over the past three months, according to the bank.

Stockpiles of iron ore inventories were believed to be on high levels as well, especially among the value chain such on vessels, port stocks and mills inventory, as compared to two years ago.