A total of 510,000 mt of iron ores was traded for the week ended Jul 23, much lesser than the 1.25 million mt of iron ore traded last week, as market was affected by output cuts.

There was less demand for raw materials after the Chinese authority asked various steelmakers in Jiangsu, Fujian and Yunnan to reduce steel output.

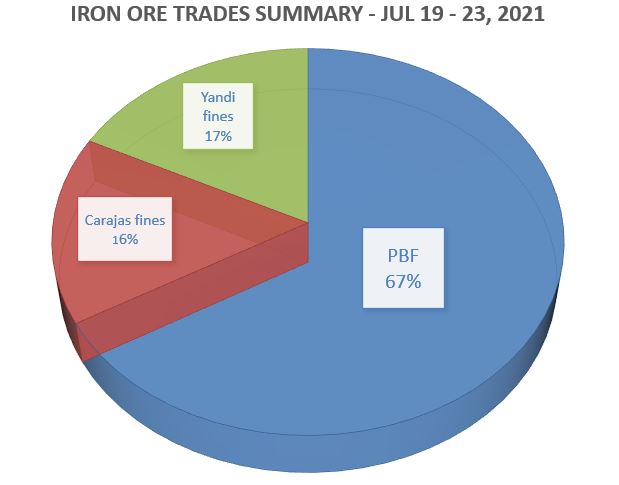

During the week, the trades volume of PBF accounted the largest market share at 67%, then followed by Yandi fines at 17%, and Carajas fines at 16%.

More mills to switch to discounted medium grade fines

More Chinese mills were heard to be seeking for discounted medium grade fines like Mac fines and Jimblebar fines and low-grade fines like SSF to save costs in the sintering mix.

This was due to the low steel margins environment, though Platts estimated some improvements in profit margins for domestic HRC and rebar at $88/mt and $24/mt respectively as of Jul 16, up $67/mt and from negative $1/mt week-on-week.

However, it was heard that PBF remained the mainstay for blending mix among the state-owned enterprise (SOE) steel mills, as they saw little needs for adjustment at the moment.

Bearish outlook for lump premiums

Lump premiums became more bearish as mills were heard to reduce pellet and lump usages in expectation of more output cuts being imposed.

Moreover, the lump demand was also lowered by more supplies in the secondary market and the reselling of portside stocks.

Steel mills were heard to seek for more cost-efficient alternatives, while there was growing market concerns about the flood situation in Henan province that disrupted transportation and logistics.