A total of 810,000 mt of iron ores was traded for the week ended Apr 29, as Chinese restocking activities came to close before the upcoming long holidays in China.

There were also some market concerns over widening lockdown measures in China, though both major cities like Beijing and Shanghai experienced some stabilization over previous rising covid cases.

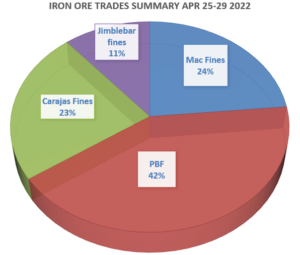

During the week, the trades volume of PBF accounted the largest market share at 42%, then followed by Mac fines at 24%, and then Carajas fines at 23%.

End of restocking activities for the Chinese mills

Most Chinese mills were heard to complete most of their restocking activities ahead of the Labor Day holidays in early May.

Though, there was still some market interests for low grade fines, due to their cost efficiency in the low steel margins environment.

Hence, some buyers were heard to be seeking for SP10 fines, as they could not get their hands on SSF due to limited availability and overheated demand.

There was also more enquires for PBF recently for its cost efficiency, while the sales of Yandi fines were doing well at the ports, due to positive import margins between seaborne and portside markets.

More Chinese infrastructure stimulus package on the way

The Chinese government had pledged to promote infrastructure construction to stimulate the domestic economy, which was embattled by the recent fresh round of Covid outbreaks that resulted in more lockdown measures.

As the country’s Central Financial and Economic Affairs Commission held meeting this week to discuss ways to boost domestic economic and social development for the market.

Meanwhile, the Metallurgical Mines Association of China (MMAC) predicted iron ore demand to remain high in the country over the long run, due to the growing domestic steel sector.

As such, MMAC expected iron ore demand to reach 17.5 billion mt for the next 15 years, implying an iron ore shortage of 13 billion mt.