A total of 730,000 mt of iron ores was traded for the week ended Dec 3, amid thin market activity, though market participants expected more steel production in December.

This was due to the relaxation of production curbs in Tangshan, though the policy may reverse soon to improve the air quality ahead of the Winter Olympics.

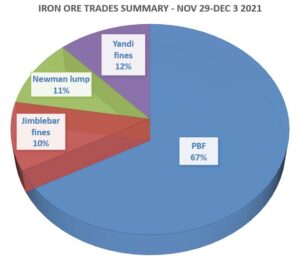

During the week, the trades volume of PBF accounted the largest market share at 67%, followed by Yandi fines at 12%, and then Newman lump at 11%.

Mills prefer medium grade fines amid higher output in December

Many trade participants expected a steel production recovery in December, due to the easing of output restrictions.

According to trade sources, most of the iron ore demand will come in form of medium grade fines, especially for discounted medium grade fines, due to low steel margin environment.

As trade participants viewed discounted products as more cost efficiency than PBF, while more market participants were interested in low grade fines with wider discounts such as FMG SSF with 41% discount in December.

Thus, some mills were heard to resell less discounted mainstream fines like PBF to replace them with better discounted medium grade fines.

Mixed market outlook for lump demand

Lump demand posed a mixed outlook, as trade participants expected more production restrictions and sintering curbs before the Winter Olympics that might hurt lump demand.

However, more mills stick to lump as direct feed for cost-efficiency during the sintering curbs and lowered their usage on pellets.

This was due to higher pellet prices with limited supply from India, while the lowering coke prices also boost some supports for lump premiums.