A total of 590,000 mt of iron ores was traded for the week ended Jul 30, up 15.69% week-on-week, as the Chinese steel demand was constrained by output cuts.

The steel production had slowed down with extending output cuts over various Chinese provinces, while rainy weather affected steel demand and logistics.

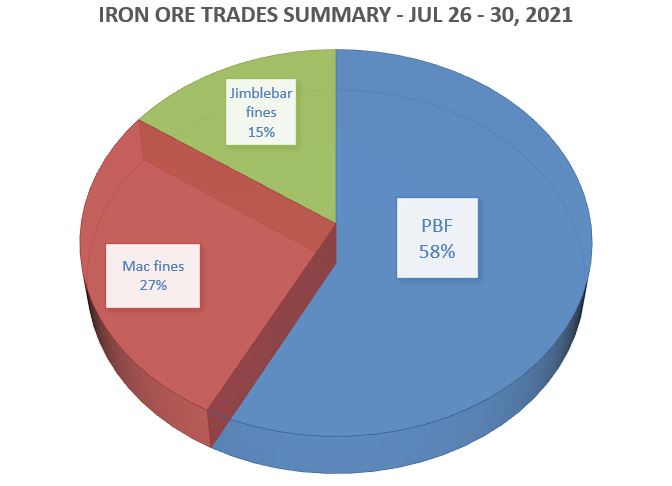

During the week, the trades volume of PBF accounted the largest market share at 58%, then followed by Mac fines at 27%, and Jimblebar fines at 15%.

Chinese mills prefer cost savings instead of productivity

More Chinese mills were focused on cost saving modes and thus preferred discounted medium to low grade fines over high grade-mainstream fines for higher productivity.

However, it was heard that mainstream medium grade fines like PBF were still sought after by the large mills, though there were growing interests on low grade fines like SSF due to their liquidity.

There was also some demand for low grade Indian fines, but the imported Indian fines faced more delays, due to the cargo restriction at Chinese ports to prevent the spread of Covid pandemic.

Extending output cuts across Chinese provinces

So far, the steel mills from 12 provinces, as well as Shanghai and Chongqing municipality, have been notified by Chinese authority to maintain their crude steel production below 2020 levels.

These measures were joined by mills based in Shandong province, which pledged to cut its overall crude steel production in 2021 by 17% or 15 million mt in comparison to previous year output.

Southern China-based mills were heard to reduce steel output by a loss of around 17,000 mt/day, starting in mid to late July, as part of power saving measures during summer season.