A total of 2.68 million mt of iron ores was traded for the week ended Nov 20, nearly doubled week-on-week, as compared to 1.82 million mt recorded last week.

The high transaction volume was attributed to active restocking activities that typically occurred at the second half of November ahead of the winter season.

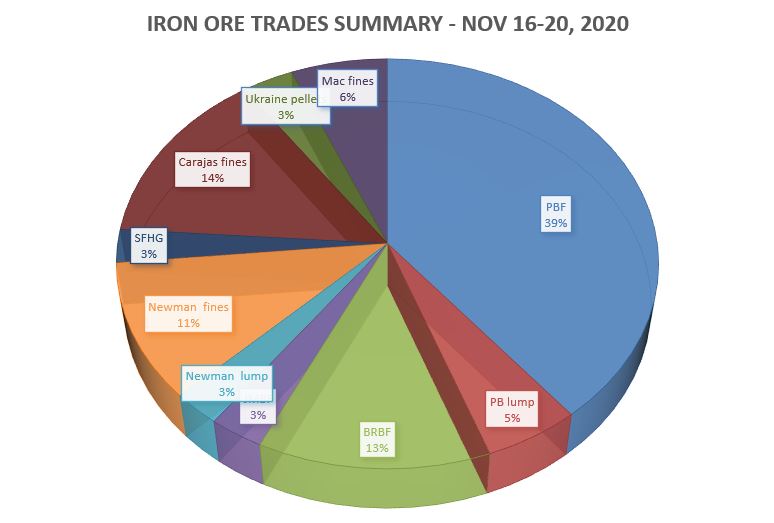

PBF had once again become the most popular iron ore products traded for the week at 39%, then seconded by Carajas fines at 14%, and finally BRBF came in third at 13%.

Switch to more usage for medium grade fines

PBF accounted for the most sales this week, as end-users seek for medium grade fines, which were more cost efficiency than the low grade fines.

More buyers also seek for high grade ores like BRBF for its higher Fe and lower alumina content, as well as its narrowing spread for the Fe 65%-Fe 62%, which was just trading at RMB 5-10/wmt higher than medium grade ores at portside.

According to trade source, some end-users were heard to be seeking Newman High Grade fines (NHGF) over PBF, due to their higher iron content.

In contrast, the low grade fines like Yandi fines were losing their popularity among buyers as well as other low grade brands like Super Special fines and Fortescue Blend Fines.

More headwinds for lump

The environmental curb had been lifted in Tangshan and Handan this week, but the market participants expected little impact on the lump market as the recent output cuts were considered mild.

Besides, the lump demand was constrained by high lump inventories at portside, while most lump ratios at blast furnaces had almost reached their limits.

In the meantime, end-users were heard to turn to cheaper lump options like the SP10 lump and FMG lump for cost-saving and better cost-efficiency as compared to the imported pellet options.